COMEX Gold: Rebounding Above the USD1,800 Level

rhboskres

Publish date: Thu, 23 Dec 2021, 05:32 PM

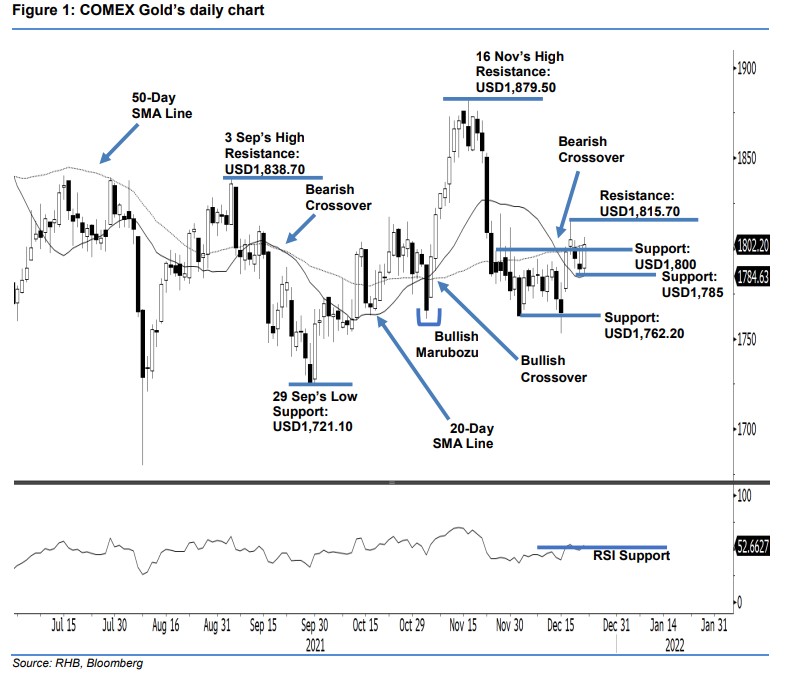

Maintain short positions. The COMEX Gold bounced higher yesterday, climbing USD13.50 to settle at USD1,802.20 and crossing above the USD1,800 resistance. It opened at USD1,789.40 and gradually moved lower to touch the USD1,785.80 intraday low before shifting direction northwards towards the day’s high of USD1,806.3 prior to the close. The white body candlestick – formed above the USD1,800 resistance – indicates the re-emergence of the bullish momentum. We expect the COMEX Gold to move higher towards USD1,815.70 in the coming sessions. This is supported by the strengthening of the RSI, which is pointing above the 50% level. In anticipating the potential strong bullish momentum ahead, we introduce a trailing-stop based on the latest day’s high. We keep our negative trading bias until the revised trailing-stop is triggered.

We suggest traders keep the short positions initiated at USD1,809, or the closing level of 22 Nov. For risk management, the trailing-stop is introduced at USD1,806.30 – the high of 22 Dec.

The immediate support is revised to the USD1,800 threshold, followed by USD1,785, 21 Dec’s low. Towards the upside, the nearest resistance is set at USD1,815.70, or 17 Dec’s high, followed by USD1,838.70, or 3 Sep’s high.

Source: RHB Securities Research - 23 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024