WTI Crude: Bouncing Higher Towards the Immediate Resistance

rhboskres

Publish date: Thu, 23 Dec 2021, 05:33 PM

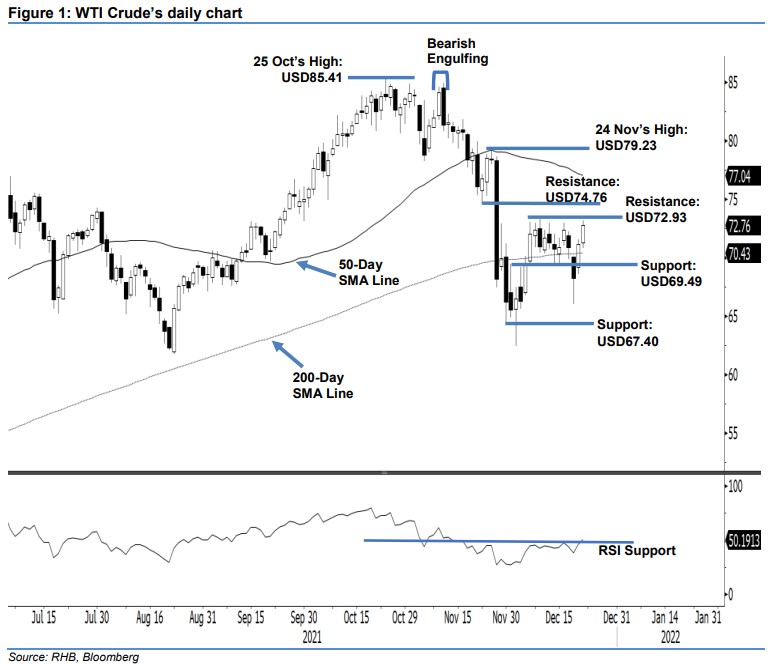

Keep short positions. The WTI Crude rebounded sharply yesterday, as it rose USD1.64 to settle at USD72.76 – eyeing the USD72.93 immediate resistance. The black gold opened at USD71.27 and moved in a sideways direction to touch the intraday low of USD70.80 during early European trading session. Buying pressure then emerged to shift the direction northwards until the end of the session. It hit the day’s high of USD73.16 before the close. The latest long white body candlestick for two consecutive sessions following the recent pullback is in line with our immediate term bullish momentum towards the USD72.93 immediate resistance. With the improving RSI towards above the 50% level, the odds for the black gold to move beyond the immediate resistance level is high. However, the bullish bias may only emerge if it manages to surpass that level – forming a “higher high” bullish structure. As such, we keep to our negative trading bias until the stop-loss is triggered.

Traders are advised to maintain the short positions initiated at USD68.23 – the closing level of 20 Dec. To manage the downside risks, the initial stop-loss threshold is pegged at the USD72.93 resistance level.

The immediate support is still at USD69.49 – 1 Dec’s high – followed by USD67.40 – 26 Nov’s low. The nearest resistance is fixed at USD72.93, ie 29 Nov’s high – followed by USD74.76, ie 22 Nov’s low.

Source: RHB Securities Research - 23 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024