FCPO: Propelling Strongly Above The MYR4,500 Level

rhboskres

Publish date: Mon, 27 Dec 2021, 08:41 AM

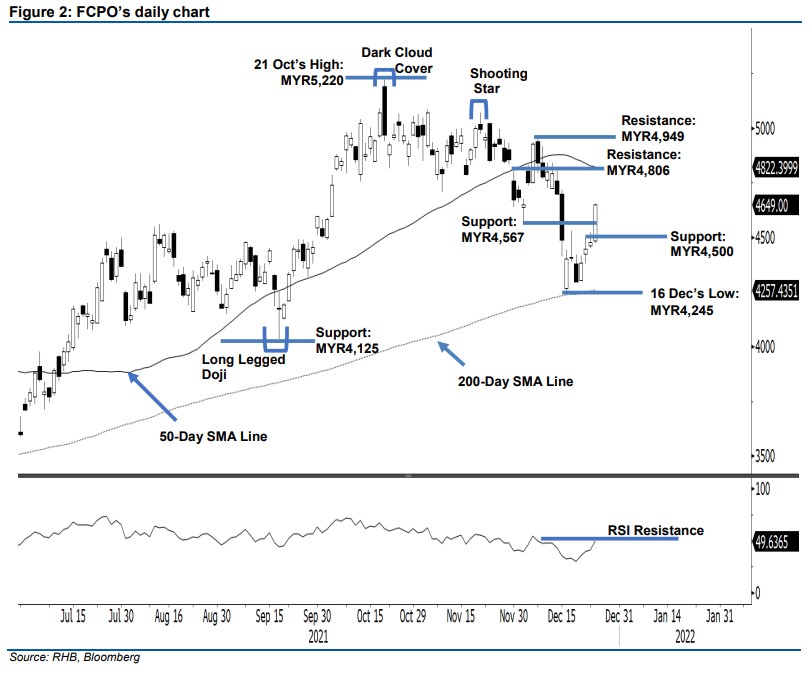

Trailing-stop triggered; initiate long positions. The FCPO saw a sharp uptrend movement on Friday, as it closed MYR171.00 higher at MYR4,649 – breaching strongly above the MYR4,520 trailing stop. The commodity opened on a positive tone at MYR4,483 and touched the day’s low of MYR4,471 before propelling higher towards the close. It touched the day’s high of MYR4,653, ie near its close. The latest long white body candlestick – breaching above both the MYR4,500 and MYR4,567 resistance levels – implies that the strong buying momentum has emerged to navigate the upcoming sessions towards north. Coupled with the latest “higher high” bullish structure, we anticipate the commodity to propel northwards towards the MYR4,806 resistance, which is near the 50-day SMA line of MYR4,822. Since the trailing-stop was triggered, we shift to a positive trading.

We closed out our short positions, initiated at MYR4,699 or the closing level of 14 Dec, after the trailing-stop at MYR4,520 was triggered. Conversely, we initiate long positions at the closing level of 24 Dec at MYR4,649. To manage trading risks, the initial stop-loss threshold is placed at the MYR4,500 threshold.

The immediate support is revised to MYR4,567, followed by MYR4,500. Towards the upside, the immediate resistance is revised to MYR4,806 – 30 Nov’s high, then MYR4,949 or 8 Dec’s high.

Source: RHB Securities Research - 27 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024