FKLI: Extending Higher

rhboskres

Publish date: Tue, 28 Dec 2021, 08:35 AM

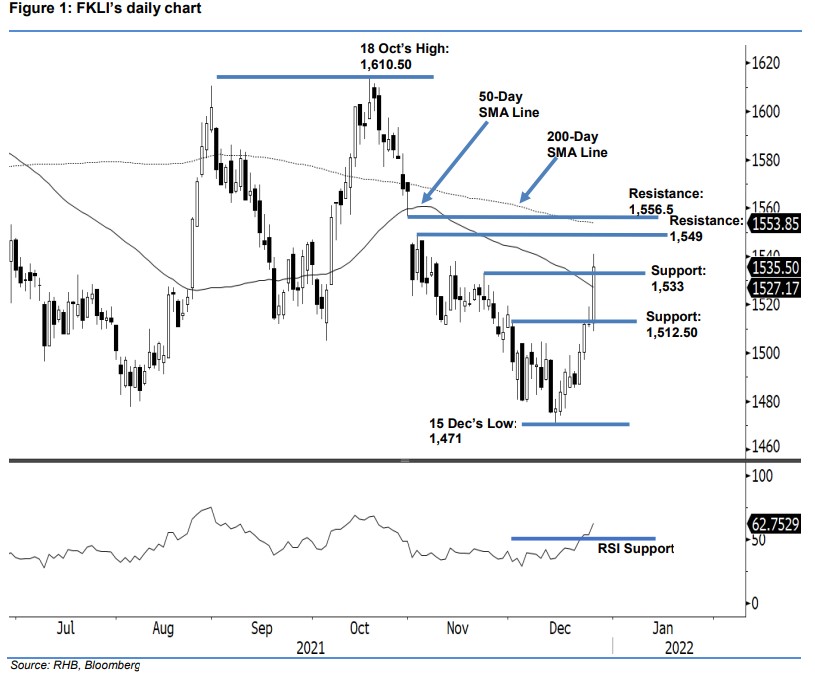

Maintain long positions. The FKLI continued with a stronger momentum after surging 23.5 pts yesterday to close at 1,535.5 pts – pushing above the 50-day average line. The index opened at 1,512.5 pts, then touched the 1,509-pt intraday low before propelling north towards the end of the session. It hit the day’s high of 1,541 pts before the close. Yesterday’s long bullish candlestick – where it crossed above the 50-day average line and immediate resistance – indicates that the index has resumed its rally yesterday following the pause on Friday – printing a “higher high” bullish structure above the average line. Furthermore, the RSI strength is getting stronger at above the 60% level, indicating further room for an upside in the medium term. As such, we remain our positive trading bias until the trailing-stop is breached.

We recommend that traders stick to the long positions initiated at 1,496.5 pts, or the closing level of 1 Dec. To mitigate trading risks, we revise the trailing-stop to 1,510.5 pts – 24 Dec’s low. The immediate support has been revised upwards to 1,533 pts or 23 Nov’s high, followed by 1,512.5 pts –16 Nov’s low. Towards the upside, the resistance levels are set at 1,549 pts – the high of 2 Nov, followed by 1,556.5 pts, or the low of 29 Oct.

Source: RHB Securities Research - 28 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024