FCPO: Rally Continues Towards 50-Day SMA Line

rhboskres

Publish date: Wed, 29 Dec 2021, 06:01 PM

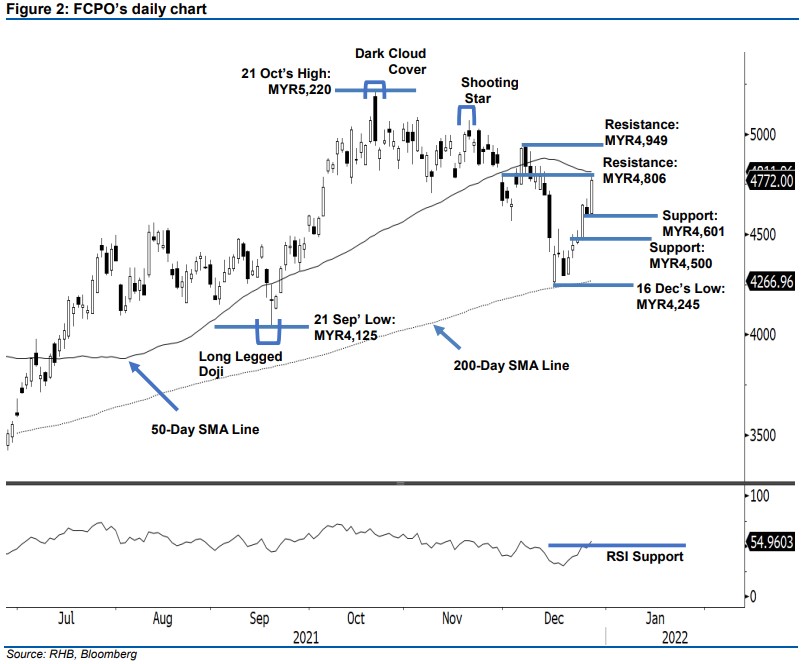

Keep long positions. Following the mild retracement on Monday, the FCPO continued its rally yesterday after it gained MYR168.00 to close at MYR4,772 – eyeing the 50-day average line and the immediate resistance. The commodity opened at MYR4,606 and grazed the day’s low of MYR4,603 before gradually climbing higher towards hitting the intraday high of MYR4,796 prior to the close. The latest long white body candlestick is firming up the recent rally, and the FCPO may cross above the 50-day average line in the medium term – printing another “higher high” bullish structure. Take note that the recent strong rally kicked off from the 200-day average line on 16 Dec to approach the 50-day average line yesterday. As the RSI is hovering above 50%, we expect to see further room for an upside in the medium term. Nevertheless, we do expect a mild retracement to take place in the coming sessions before thje FCPO continues rallying towards the area above the 50-day SMA line. As such, we maintain a bullish trading bias.

Traders should remain in the long positions initiated at MYR4,649, or the closing level of 24 Dec. To manage trading risks, the initial stop-loss threshold has been lifted to the immediate support of MYR4,601.

The immediate support is changed to MYR4,601 – 27 Dec’s low, followed by MYR4,500. Towards the upside, the immediate resistance is still at MYR4,806 – 30 Nov’s high, then MYR4,949 or 8 Dec’s high.

Source: RHB Securities Research - 29 Dec 2021

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024