E-Mini Dow: Selling Momentum Continues

rhboskres

Publish date: Mon, 03 Jan 2022, 09:39 AM

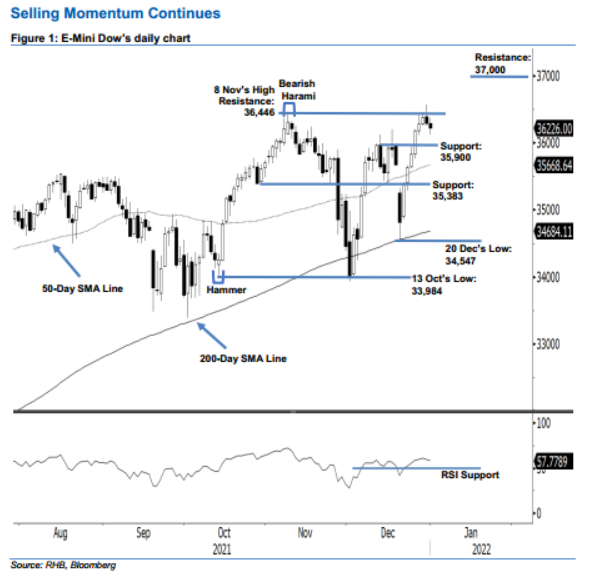

Trailing-stop triggered; initiate short positions. Amid strong intraday profit taking on Thursday, the E-Mini Dow fell again on the last trading session of 2021, shedding 65 pts to settle at 36,226 pts. It initially opened at 36,296 pts and oscillated in a choppy session between the intraday low of 36,121 pts and the 36,371-pt high throughout the session. It finally retraced from the day’s high to close lower. Note that the index rebounded strongly from the 200-day SMA line on 20 Dec towards printing the all-time high (closing price) on 29 Dec 2021. However, we expect the index to take profit further towards near the 35,900-pt support in the immediate term. Since the trailing-stop was triggered, we shift to a negative trading bias.

We closed out our long positions, initiated at 36,178 pts, or the closing level of 27 Dec, after the trailing-stop at 36,255 pts was triggered. Conversely, we initiate short positions at the closing level of 31 Dec 2021 at 36,226 pts. For risk-management purposes, the initial trailing-stop is introduced at 36,446 pts, or 8 Nov’s high.

The immediate support is set at 35,900 pts – 26 Nov’s high – and followed by 35,383 pts, which was 27 Nov’s low. The immediate resistance points are pegged at 36,446 pts – 8 Nov’s high – and 37,000 pts.

Source: RHB Securities Research - 3 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024