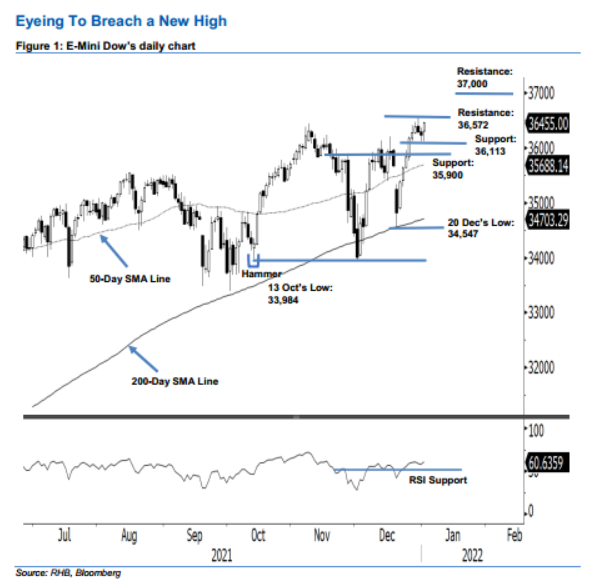

E-Mini Dow: Eyeing to Breach a New High

rhboskres

Publish date: Tue, 04 Jan 2022, 09:55 AM

Stop-loss triggered; initiate long positions. The E-Mini Dow surged on the first trading session in 2022, rising 229 pts to settle at 36,455 pts. Yesterday, it opened at 36,304 pts, then fell to the session’s low of 36,120 pts during the European trading hour. However, strong buying interest emerged during the US trading session, lifting the index to touch the session’s high of 36,472 pts before the close. The latest session shows that the bulls have knocked the bears off and regained control. With improved sentiment, the index may attempt to test the historical high of 36,572 pts. Breaching the threshold would see the index scaling towards the uncharted territory of 37,000 pts. We shift to a positive trading bias after the stop-loss was triggered.

We closed out our short positions, initiated at 36,226 pts, or the closing level of 31 Dec, after the stop-loss at 36,446 pts was triggered. Conversely, we initiate long positions at the closing level of 3 Jan 2022 at 36,455 pts. For riskmanagement purposes, the initial stop-loss is set at 35,600 pts.

The immediate support revised to 36,113 pts – 28 Dec 2020’s low – followed by 35,900 pts, or the high of 26 Nov. On the upside, the nearest resistance would be 36,572 pts – 30 Dec 2020’s high – and the higher resistance of 37,000 pts.

Source: RHB Securities Research - 4 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024