FKLI - Extension Of Profit-Taking Activities

rhboskres

Publish date: Wed, 05 Jan 2022, 05:53 PM

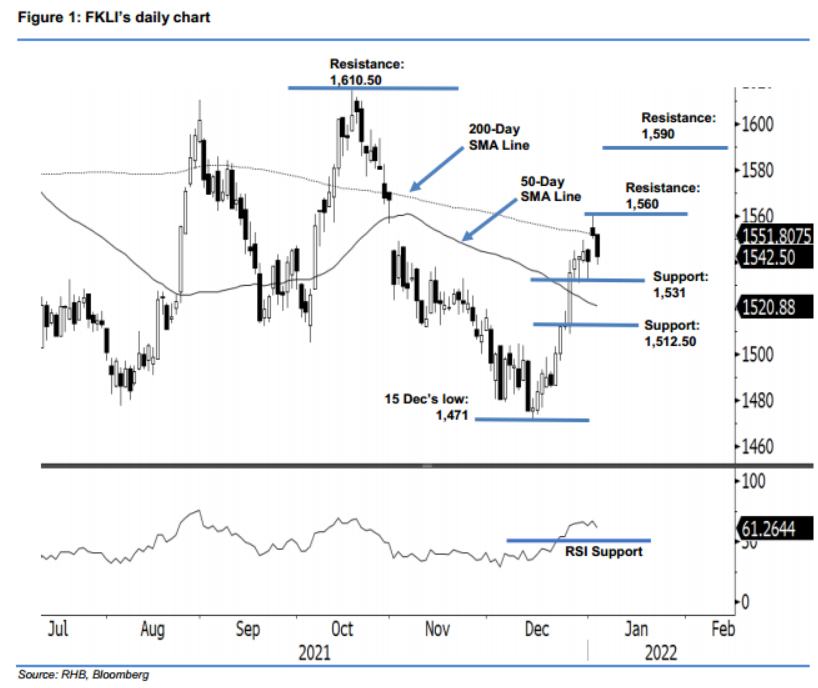

Maintain long positions. The FKLI continued to undergo selling pressure near the 200-day SMA line. The benchmark index ceded 9 pts to close at 1,542.50 pts. On Tuesday, after opening at 1,552 pts, it turned southwards as investors took profit, then printed the session’s low of 1,539 pts before closing. The negative price action indicates that selling pressure was too strong near the 200-day SMA line. As such, traders may expect to see a further consolidation in the coming sessions. Meanwhile, strong support could be found near the 1,531-pt level. We will maintain a positive trading bias until the stop-loss is breached.

We recommend that traders hold on the long positions initiated at 1,500.50 pts, ie the close of 22 Dec. To minimise the trading risks, the stop-loss is placed at 1,531 pts. The immediate support remains at 1,531 pts – 29 Dec’s low – followed by 1,512.50 pts or the high of 23 Dec.

Meanwhile, the nearest resistance is at 1,560 pts, followed by the higher hurdle of 1,590 pts.

Source: RHB Securities Research - 5 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024