E-Mini Dow - Printing a New High

rhboskres

Publish date: Wed, 05 Jan 2022, 06:03 PM

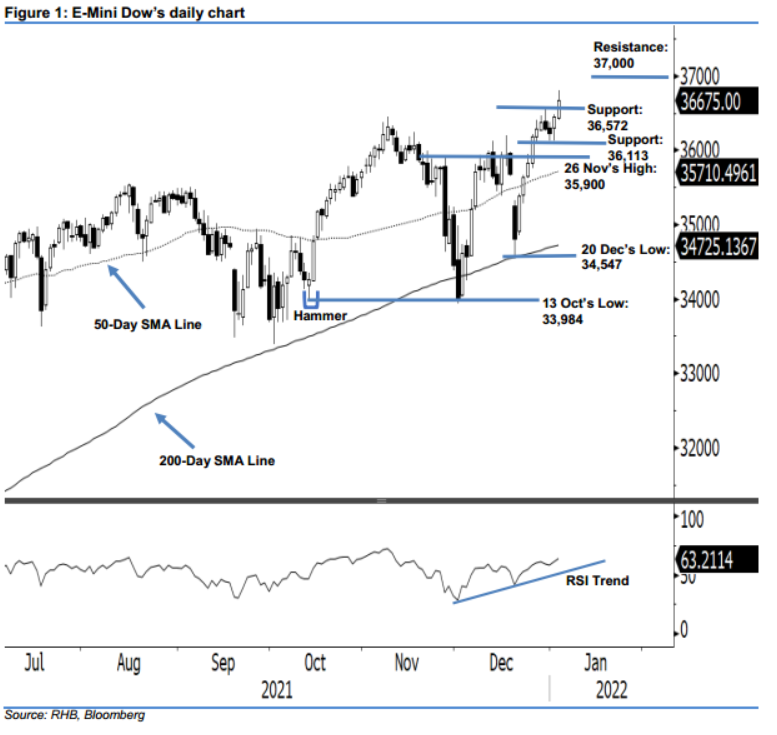

Maintain long positions. The E-Mini Dow continued the recent rebound to mark a new high yesterday, adding 220 pts to settle at 36,675 pts – crossing above the 36,572-pt immediate resistance. It opened lower yesterday at 36,432 pts, then touched the session’s low of 36,409 pts before buying pressure kicked in causing it to rise gradually until the end of the session. It hit the intraday high at 36,804 pts during the US trading session before experiencing a pullback towards 36,675 pts close. The latest bullish session, marking a new high, implies that the bulls are set to propel higher towards the uncharted territory. With improved RSI strength at the 63% level, the index is expected to print another new high level at 37,000 pts and 37,500 pts. Therefore, we stick to our positive trading bias, which we shifted to in our previous note.

Traders are expected to keep the long positions initiated at 36,455 pts – the closing level of 3 Jan 2022. For risk management purposes, the stop-loss is revised to 36,113 pts.

The immediate support is adjusted to 36,572 pts – 30 Dec 2020’s high, followed by 36,113 pts – 28 Dec 2020’s. Towards the upside, the nearest resistance is eyed at 37,000 pts – with the higher resistance set at 37,500 pts.

Source: RHB Securities Research - 5 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024