WTI Crude - Bouncing Above the 50-Day SMA Line

rhboskres

Publish date: Wed, 05 Jan 2022, 06:04 PM

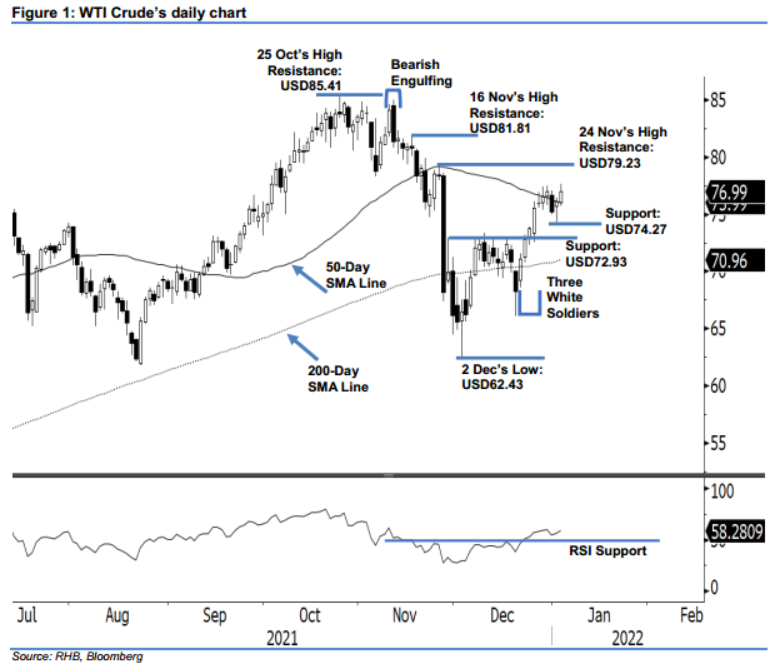

Maintain long positions. The WTI Crude continued to rebound higher yesterday, gaining USD0.91 to close higher at USD76.99 and reclaiming above the 50-day average line. The commodity opened at USD76.02, only to oscillate sideways during the Asian trading session where it hit the day’s low of USD75.70. However, strong buying interest emerged during the European trading session to propel the commodity northwards to hit the intraday high of USD77.64 before retracing moderately towards the close. The latest session’s white body candlestick following Monday’s rebound suggests the bulls are on track to push past the 50-day average line – amid printing the “higher low” bullish structure. With the RSI pointing higher towards the 60% level, the positive momentum may continue to lift the commodity towards the next resistance at USD79.23. With that, we keep to our positive trading bias until the stop-loss is triggered.

Traders are recommended to retain the long positions inititated at USD73.79, or the closing level of 23 Dec. To manage trading risks, the initial stop-loss is placed at the USD72.93 support.

The support levels are revised to USD74.27 (3 Jan’s low), and USD72.93 – 29 Nov’s high. Meanwhile, the immediate resistance is fixed at USD79.23 (24 Nov’s high), followed by USD81.81, or the high of 16 Nov.

Source: RHB Securities Research - 5 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024