WTI Crude: Eyeing the Immediate Resistance

rhboskres

Publish date: Thu, 06 Jan 2022, 04:45 PM

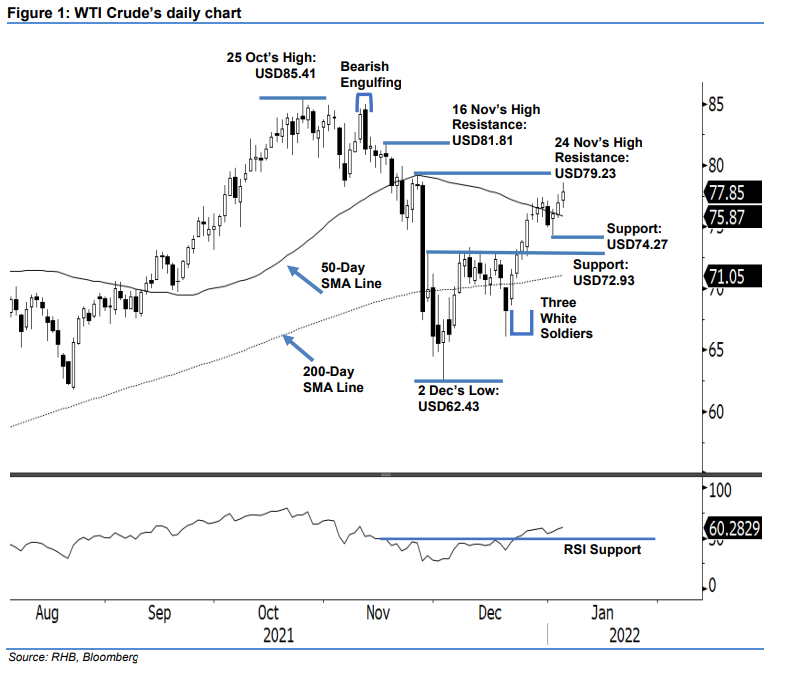

Maintain long positions. The WTI Crude continued its positive movement for the third consecutive session yesterday, rising USD0.86 to settle stronger at USD77.85 – heading towards the immediate resistance of USD79.23. The commodity started off on a positive note at USD77.18, then oscillated sideways ahead of the US trading session, hitting the day’s low of USD76.51. Strong buying momentum then emerged during the early part of the US trading session, propelling the black gold towards the intraday high of USD78.58. It then retraced moderately towards the close. The latest session’s white body candlestick – with upper and lower shadows – reaffirms the bullish bias above the 50-day average line, amid the “higher high” bullish structure printed yesterday. With the RSI stronger, at 60% yesterday, the medium-term positive momentum is on track to propel the commodity towards the immediate resistance of USD79.23. We stick to our positive trading bias.

Traders are recommended to retain the long positions initiated at USD73.79, or the closing level of 23 Dec 2021. To manage trading risks, the trailing-stop is introduced at the USD74.27 immediate support level.

The support levels remain at USD74.27 (3 Jan’s low), and USD72.93 – 29 Nov 2021’s high. The immediate resistance is still at USD79.23 (24 Nov 2021’s high), followed by USD81.81, or the high of 16 Nov 2021.

Source: RHB Securities Research - 6 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024