COMEX Gold: Falling Below the USD1,800 Level

rhboskres

Publish date: Fri, 07 Jan 2022, 05:16 PM

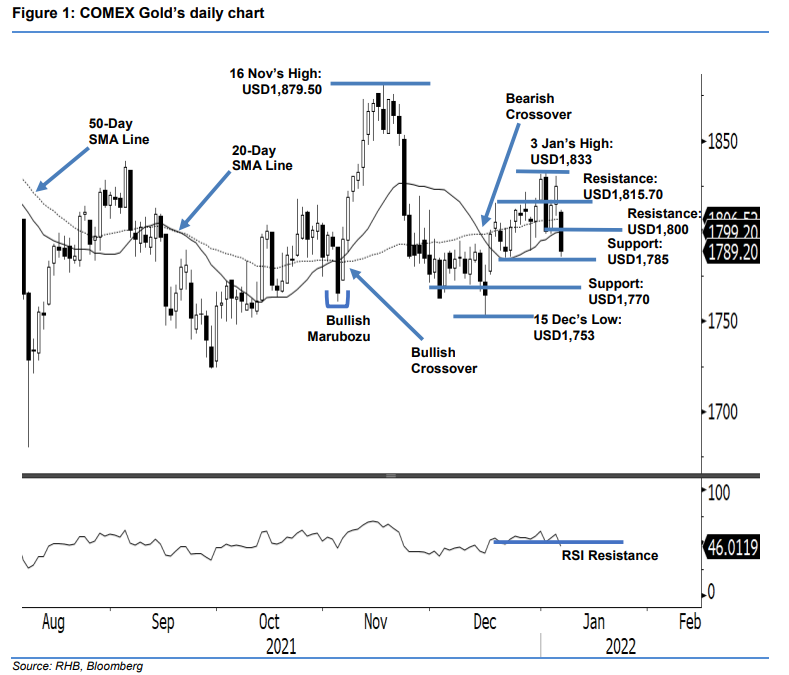

Stop-loss triggered; Initiate short positions. The COMEX Gold failed to establish a foothold above the USD1,800 level, plunging USD35.90 to settle at USD1,789.20. The commodity gapped down to open at USD1,810.60 yesterday. Sentiment was weak, and strong profit-taking dragged it towards the session’s USD1,785.40 low ahead of the close. The session saw the bearish candlestick pierce below both the 20-day and 50-day SMA lines, showing that the bears have overpowered the bulls. With the renewed bearish momentum, a follow through price action to test the USD1,785 level, followed by USD1,770 is likely. Both SMA lines will now act as overhead resistance levels. As the stop-loss was breached, we shift to a negative trading bias.

We closed out the long positions initiated at USD1,811.70, or the closing level of 23 Dec 2021, after the stop-loss at USD1,800 was breached. Conversely, we initiate short positions at the close of 6 Jan (USD1,789.20). To mitigate trading risks, the initial stop-loss is set at USD1,820.

The immediate support is revised to USD1,785, followed by USD1,770. The immediate resistance is pegged at the USD1,800 psychological level, followed by the higher resistance at USD1,815.70, or 17 Dec 2021’s high.

Source: RHB Securities Research - 7 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024