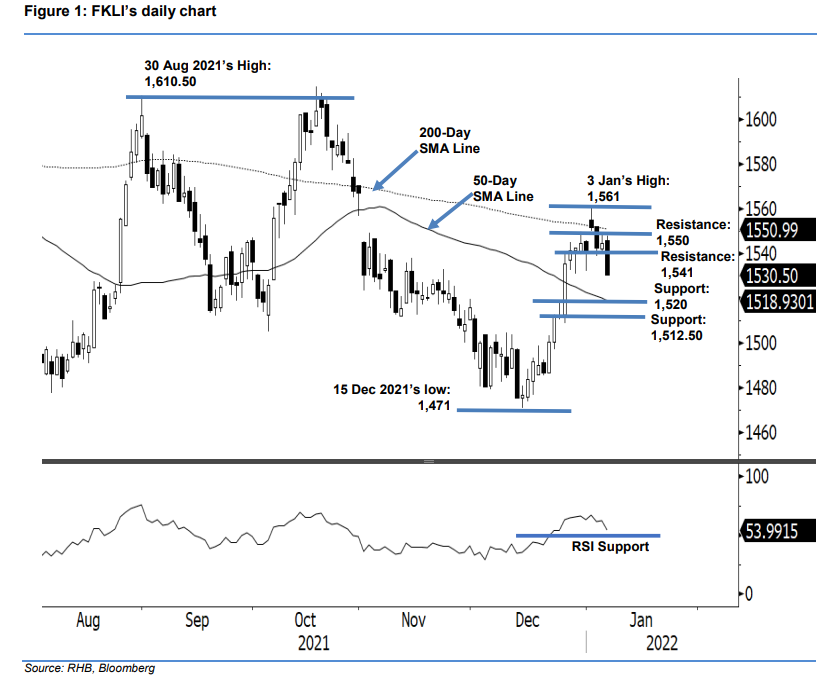

FKLI: Heading Lower Towards The 20-Day SMA Line

rhboskres

Publish date: Fri, 07 Jan 2022, 05:18 PM

Stop-loss triggered; Initiate short positions. The FKLI experienced strong selling pressure again, shedding 14 pts to settle at 1,530.50 pts. It gapped down yesterday, to open at 1,546 pts. Sentiment was negative, with the index sliding to the session’s 1,530.50-pt low to close – breaching the 1,531-pt support level. Since hitting 1,561 pts on 3 Jan, the index has experienced selling pressure near the 200-day SMA line, and has been trending downwards on lower lows. This, coupled with the latest long bearish candlestick, show that the bears still have a grip on the index. As bearish negative momentum accelerates, we expect a follow-through price action to test the next support at 1,520 pts, or the 20-day SMA line. As the stop-loss was breached, we shift to a negative trading bias.

We closed out the long positions initiated at 1,500.50 pts, or 22 Dec 2021’s close, after the stop-loss at 1,531 pts was triggered. Conversely, we initiate short positions at 6 Jan’s close (1,530.50 pts). To manage trading risks, the initial stop-loss is set at 1,555 pts.

The immediate support is revised to 1,520 pts, followed by 1,512.50 pts or the high of 23 Dec 2021. On the upside, the immediate resistance has been revised to 1,541 pts, followed by the 1,550-pt level.

Source: RHB Securities Research - 7 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024