FCPO: Mild Profit-Taking Near The MYR5,000 level

rhboskres

Publish date: Fri, 07 Jan 2022, 05:19 PM

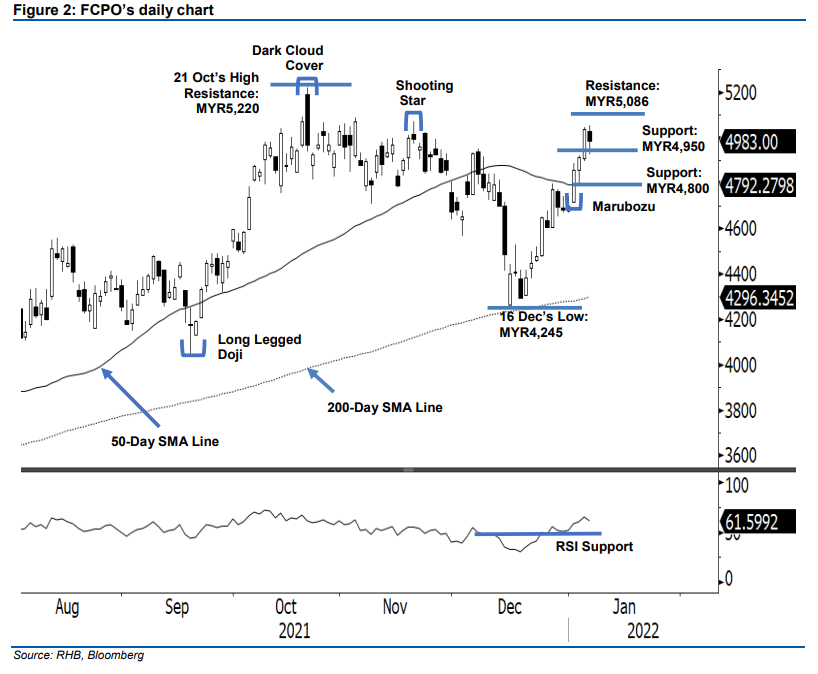

Maintain long positions. After rising for three consecutive sessions, the FCPO saw mild profit-taking near the MYR5,000 level. It retraced MYR51.00 to settle at MYR4,985. The commodity initially gapped down during Thursday’s session, to open at MYR5,029. It then fell to the session’s low of MYR4,924 before climbing to test the session’s MYR5,053 high. At the eleventh hour, strong profit-taking brought the commodity lower, to close at MYR4,985. Despite the emergence of selling pressure, and the commodity hovering near the MYR5,000 level, the latest session still printed a “higher low”, compared to Wednesday’s session. As such, a bearish reversal pattern has not formed yet, and the uptrend structure remains intact. The commodity may resume upward movement after profit-taking activity concludes. As long as the FCPO continues to stay above the 50-day SMA line, we will hold on to our positive trading bias.

We advise traders to keep the long positions initiated at MYR4,649 – the closing level of 24 Dec 2021. To manage downside risks, the trailing-stop is shifted higher to MYR4,896, or the low of 5 Jan

. The immediate support is marked at MYR4,950, followed by MYR4,800. Meanwhile, the nearest resistance is eyed at MYR5,086 – 3 Nov 2020’s high – followed by MYR5,220, or the all-time high.

Source: RHB Securities Research - 7 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024