WTI Crude: Set to Propel Higher

rhboskres

Publish date: Thu, 27 Jan 2022, 04:44 PM

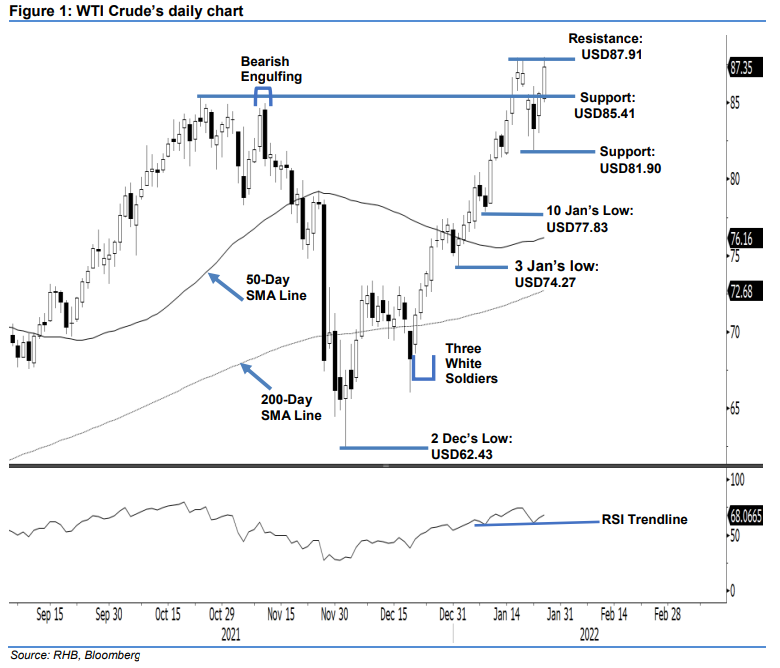

Maintain long positions. The WTI Crude continued to jump yesterday, rising USD1.75 to settle at USD87.35 as it attempted to cross above the recent high of USD87.95. The black gold started off at USD85.26 and moved sideways – while touching the USD85.01 low – before gradually climbing higher during the mid-Asian trading session. The upwards movement persisted until the mid-US trading session to hit the day’s high of USD87.95 before retracing mildly towards the close. The positive price action reaffirms Tuesday’s positive rebound following the recent pullback. This in turn solidifies the uptrend momentum to continue above the recent high level of USD87.91 in the coming sessions. Nevertheless, we do expect the WTI Crude to experience a mild pullback above the USD85.41 support. As such, we stay with our positive trading bias.

We recommend traders to keep the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. For risk management, the trailing-stop threshold is revised higher to USD81.90.

The immediate support is adjusted higher to USD85.41 – 25 Oct 2021’s high – and followed by USD81.90, ie the low of 24 Jan. Conversely, the immediate resistance is at USD87.91 – 19 Jan’s high – and followed by USD90.00.

Source: RHB Securities Research - 27 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024