Hang Seng Index Futures: Consolidating Sideways

rhboskres

Publish date: Thu, 27 Jan 2022, 04:54 PM

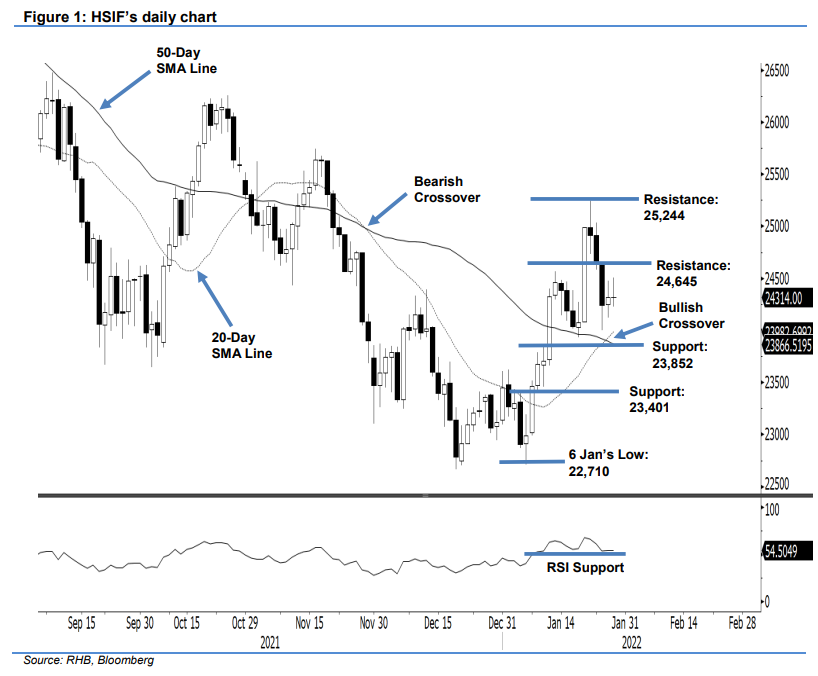

Maintain long positions. The HSIF is languishing sideways amidst neutral global cues. It recouped 79 pts yesterday to settle the day session at 24,317 pts. The index initially started off on a strong note, opening higher at 24,428 pts. After touching the 24,477-pt day high, it retreated to the 24,121-pt day low and closed at 24,317 pts. Then, in the evening session, the HSIF inched 3 pts pts lower and last traded at 24,314 pts. The bulls and bears were both adopting a wait-and-see approach yesterday. However, as the index is still establishing its position above the 50-day SMA line, we think the recent pullback is more like a consolidation of the upward movement. As long as the HSIF remains above the moving average line, the bullish momentum may pick up again. For now, we stick to our positive trading bias until the stop-loss point is breached.

Traders should retain the long positions initiated at 23,703 pts, which was the closing level of 11 Jan’s day session. For trading-risk management, the trailing-stop is fixed at 23,850 pts.

The immediate support is set at 23,852 pts – 11 Jan’s high – and followed by 23,401 pts, ie the low of 10 Jan. Conversley, the immediate resistance is pegged at 24,645 pts – 25 Jan’s high – and followed by 25,244 pts or 21 Jan’s high.

Source: RHB Securities Research - 27 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024