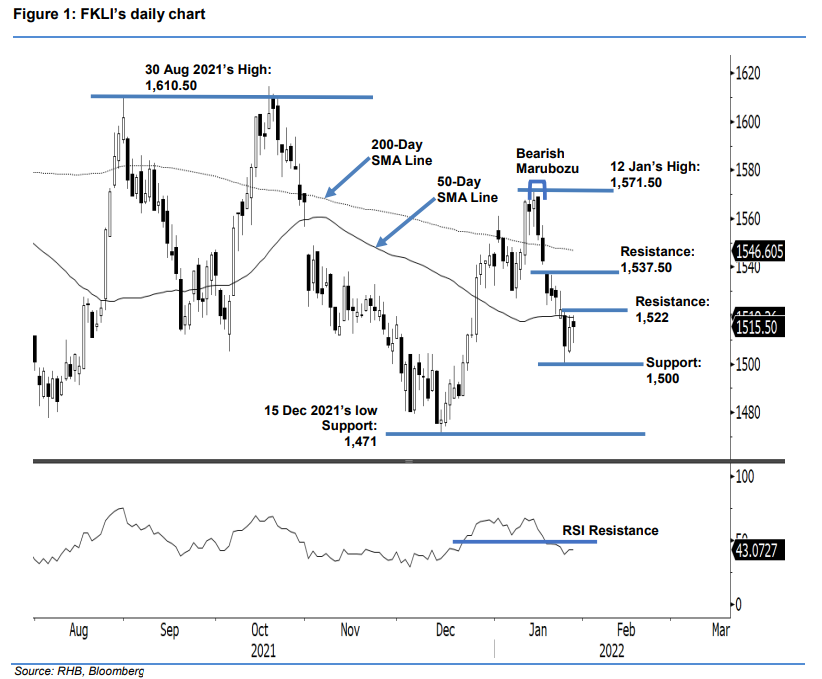

FKLI: Consolidating Near The 50-Day SMA Line

rhboskres

Publish date: Fri, 28 Jan 2022, 04:46 PM

Maintain short positions. Despite facing strong selling pressure, the FKLI managed to contain the negative momentum, adding 0.5 pts to settle at 1,515.50 pts. The index started off the night session at 1,517.50 pts. During the morning session, it dropped to the day’s low of 1,508.50 pts amid negative sentiment. The bulls managed to seize the day’s low, lifting the index towards the day’s high of 1,520 pts before closing in positive territory. Based on the recent session’s price action, the index has managed to establish its interim low at the 1,500-pt support. If the positive momentum picks up pace, we may see a technical rebound to test the 1,522-pt immediate resistance. Crossing above the 50-day SMA line may suggest early signs of the correction ending soon. The bulls may then test the higher resistance of 1,537.50 pts. Before that happens, we hold on to our negative trading bias.

Traders are advised to stay with the short positions initiated at 1,542.50 pts, or the close of 17 Jan. To mitigate the trading risks, the stop-loss is adjusted to 1,538 pts from 1,550 pts.

The immediate support is marked at the 1,500-pt psychological mark, followed by 1,471 pts, or the low of 15 Dec 2021. The first resistance is pegged at 1,522 pts – 25 Jan’s high – followed by 1,537.50 pts, which was the high of 19 Jan.

Source: RHB Securities Research - 28 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024