FCPO: Setting a New Record High

rhboskres

Publish date: Fri, 28 Jan 2022, 04:46 PM

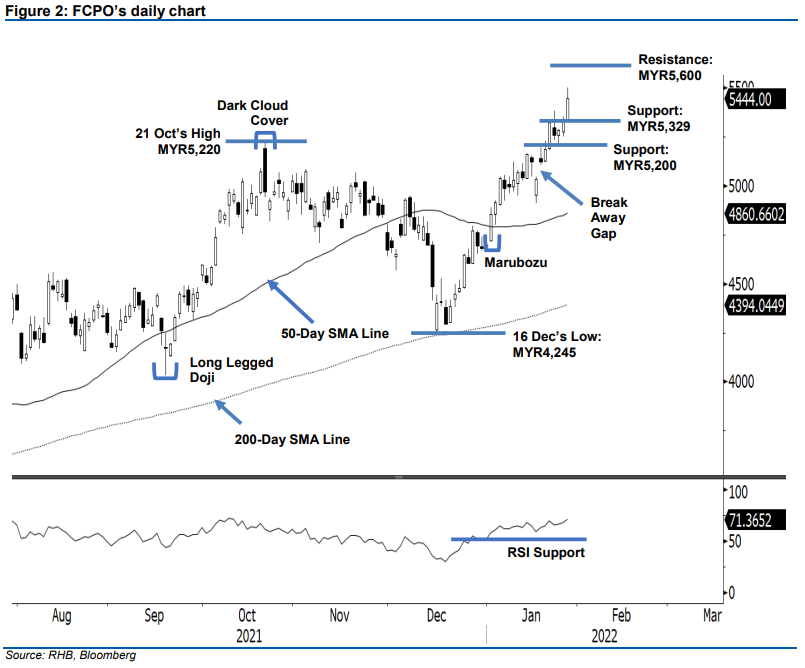

Maintain long positions. The FCPO continued to see the bullish momentum pick up pace for the third consecutive session. It rose MYR115 to settle at MYR5,444 – marking a new record high. Yesterday, the commodity began the night session at MYR5,340. It then progressed higher throughout the session, touching the MYR5,500 intraday high before the close. As mentioned in the previous note, the RSI is strengthening above the 70% level, suggesting the commodity is scaling higher on the back of strong momentum. If the commodity continues to sustain above the MYR5,329 immediate support, we may see a follow through price action to test the MYR5,600 level. In the event the bears decide to take profit, MYR5,200 will provide a strong downside support. Premised on this, we retain our positive trading bias until the trailing-stop is triggered.

Traders should keep the long positions initiated at MYR4,649, ie the close of 24 Dec 2021. To minimise the downside risks, the trailing-stop threshold is revised higher to MYR5,200 from MYR5,106.

The immediate support is shifted higher to MYR5,329 (27 Jan’s low), then the MYR5,200 round figure. Meanwhile, the immediate resistance is projected at MYR5,600, followed by MYR5,700.

Source: RHB Securities Research - 28 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024