WTI Crude: Struggling to Move Higher

rhboskres

Publish date: Fri, 28 Jan 2022, 04:50 PM

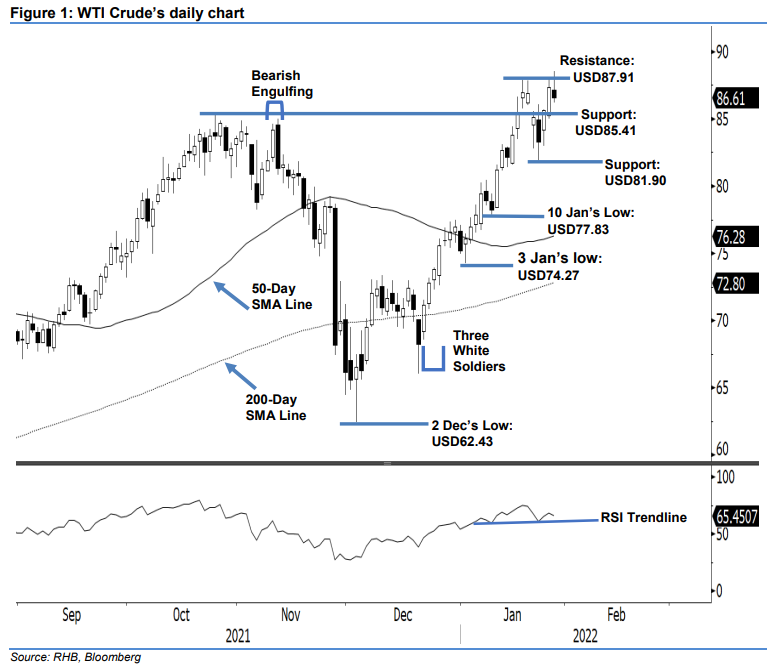

Maintain long positions. The WTI Crude wrote off all its intraday gains yesterday, declining USD0.74 to settle at USD86.61. The black gold started off lower at USD87.15 but jumped northwards to touch the day’s high of USD88.54 during the mid-US trading session. Selling pressure then appeared to reverse the direction southwards towards the end of the session, as the commodity touched the intraday low of USD86.20, ie below the opening level. The negative price action during the late sessions signals that the selling pressure below the immediate resistance of USD87.91, which indicates a pulling back below the recent high. We expect the WTI Crude to oscillate between the USD85.41 support and USD87.91 resistance in the coming sessions while remaining bullish in the medium term. Hence, we stick with our positive trading bias.

We recommend traders keep to the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. For risk management, the trailing-stop threshold is set at USD81.90.

The immediate support is pegged at USD85.41 – 25 Oct 2021’s high – and followed by USD81.90, ie the low of 24 Jan. Conversely, the immediate resistance is at USD87.91 – 19 Jan’s high – and followed by USD90.00.

Source: RHB Securities Research - 28 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024