COMEX Gold: Falling Below the 50-Day SMA Line

rhboskres

Publish date: Fri, 28 Jan 2022, 04:51 PM

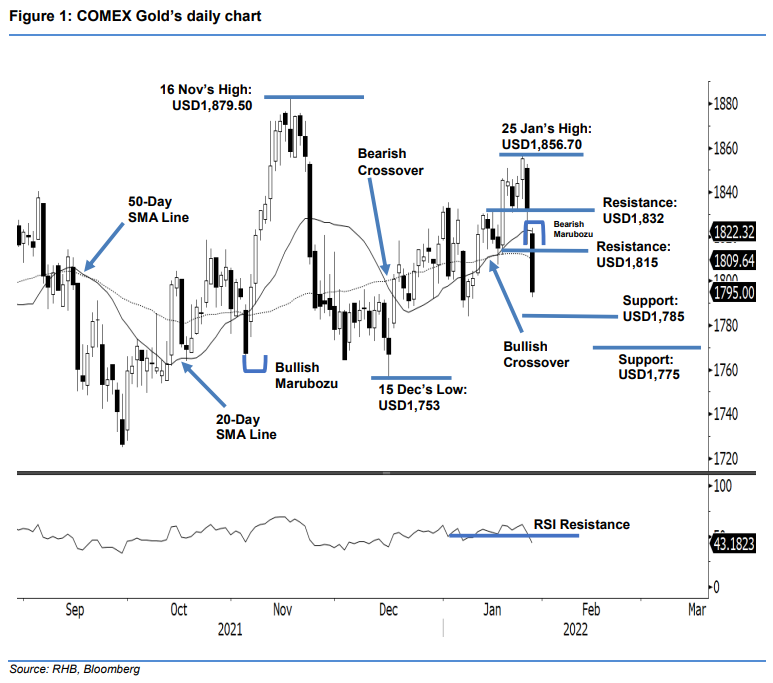

Maintain long positions. The COMEX Gold experienced strong negative momentum again yesterday, plunging USD37.00 to settle at USD1,795 – breaching the USD1,800 psychological level. The commodity started off at USD1,821.40, and moved downwards amid negative sentiment. It reached the day’s low of USD1,792.70 and closed at USD1,795. The latest session showed that volatility picks up when the non-active month contract rolls to the active month contract. At this stage, the Bearish Marubozu has nullified the Bullish Crossover of the two moving average lines – the bears are now in control. If negative momentum continues, the COMEX Gold may retrace towards USD1,785, followed by the critical support level of USD1,775. Meanwhile, the 50-day SMA line will now act as a resistance. We hold on to our positive trading bias until the stop-loss is triggered.

Traders should stick with the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To minimise downside risks, the initial stop-loss threshold is set at USD1,775.

The immediate support is shifted lower to USD1,785, followed by USD1,775. Meanwhile, the immediate resistance is revised to USD1,815, and the higher hurdle is pegged at USD1,832, which was the close of 26 Jan.

Source: RHB Securities Research - 28 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024