Hang Seng Index Futures: the Bears Are in Control

rhboskres

Publish date: Fri, 28 Jan 2022, 04:52 PM

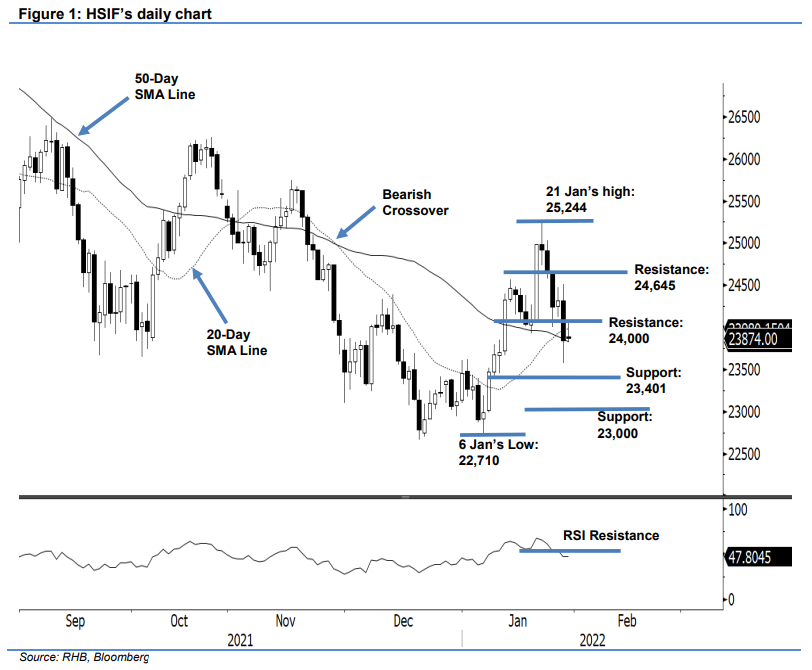

Trailing-stop triggered; Initiate short positions. The HSIF slipped below the 20-day SMA line, retreating 477 pts to settle yesterday’s day session at 23,840 pts. It opened at the day session’s high of 24,100 pts. Selling pressure then dragged it to the 23,569-pt day low before the close. The index recouped 34 pts in the evening session, and last traded at 23,874 pts. Volatility has picked up, as the January futures contract is expiring soon. If negative momentum follows through, the index may drop below the 50-day SMA line, and head towards 23,401 pts. Meanwhile, the 24,000-pt level will act as a strong psychological mark, and the bulls may attempt to reclaim this threshold in coming sessions. For now, momentum has breached below the trailing-stop, and hence, we shift over to negative trading bias.

We closed out the long positions initiated at 23,703 pts, or the closing level of 11 Jan’s day session, after the trailing-stop at 23,850 pts was triggered. Conversely, we initiate short positions at the close of 27 Jan’s day session, or 23,840 pts. To manage trading risks, the initial stop-loss is set at 24,645 pts.

The immediate support is shifted lower to 23,401 pts (10 Jan’s low), followed by 23,000 pts. Meanwhile, the immediate resistance is pegged at the 24,000-pt psychological mark, and subsequent resistance at 24,645 pts, which was the high of 25 Jan.

Source: RHB Securities Research - 28 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024