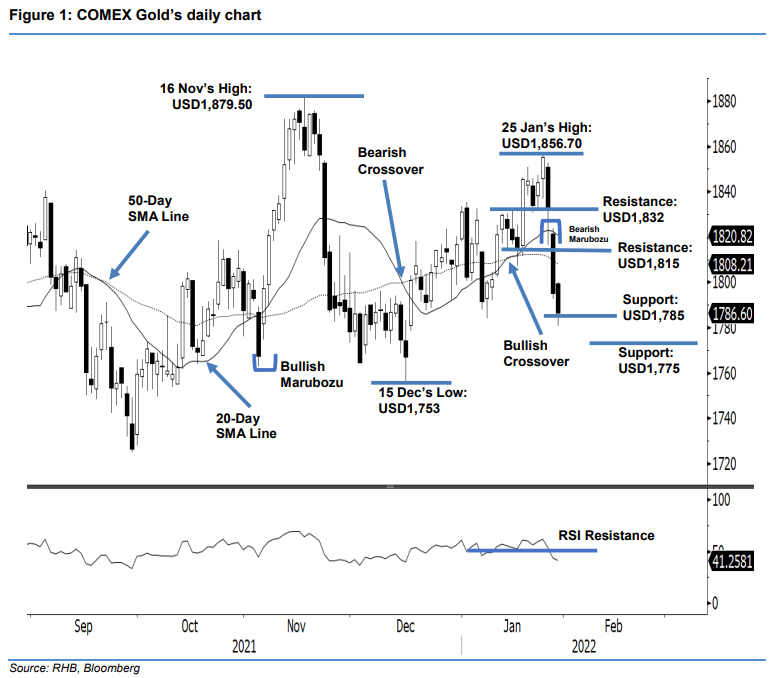

COMEX Gold: Falling Below the USD1,800 Mark

rhboskres

Publish date: Mon, 31 Jan 2022, 08:46 AM

Maintain long positions. After falling below the USD1,800 psychological mark, the COMEX Gold corrected further last Friday, retreating USD8.40 to settle weaker at USD1,786.60 – barely above the USD1,785 support. The commodity started off the session at USD1,799.60. After touching the USD1,800.30 intraday high, it progressed lower and reached the USD1,780.60 intraday low before the close. Since recording January’s high at USD1,856.70, the COMEX Gold has been retracing for a third consecutive session, but still managed to stay above the USD1,775 critical support. If it is able to establish an interim base above this threshold, it may consolidate sideways. Otherwise, once the negative momentum accelerates and breaches USD1,775, the commodity will retreat towards USD1,750. We are keeping our positive trading bias until the stop-loss point is breached.

We recommend traders hold on to the long positions initiated at USD1,818.50 or the closing level of 11 Jan. To protect the downside risks, the initial stop-loss threshold is placed at USD1,775.

The immediate support is marked at USD1,785, followed by the USD1,775 whole number. Conversley, the immediate resistance remains at USD1,815 while the subsequent resistance is pegged at USD1,832, ie the close of 26 Jan.

Source: RHB Securities Research - 31 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024