E-Mini Dow: Bouncing Off the Immediate Support

rhboskres

Publish date: Mon, 31 Jan 2022, 08:48 AM

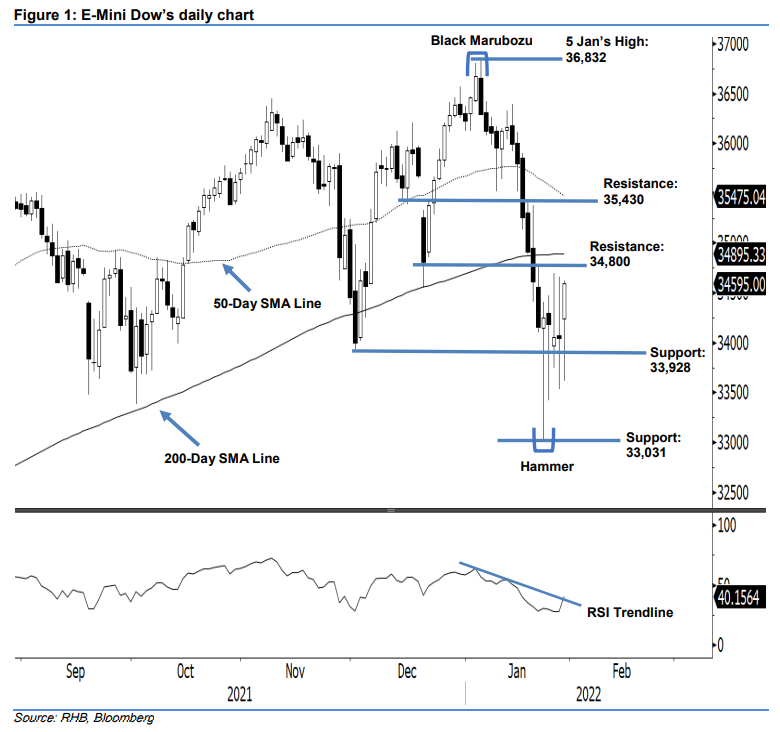

Still short positions. The E-Mini Dow recouped all its intraday losses and bounced higher last Friday, adding a strong 552 pts to settle at 34,595 pts. It opened positive at 34,240 pts before whipsawing between the 33,613-pt day low and 34,622-pt day high throughout the session. The index fell gradually prior to the US trading session, which then saw strong buying interest emerge to propel it higher towards the end of the session. The E-Mini Dow closed near its day’s high at 34,595 pts. The session’s long white body candlestick with long lower shadow shows that the momentum shift from selling to buying above the support is obvious – in turn this sees the uptrend rebound as imminent, which is also supported by the significant strengthening of the RSI during the latest session. Nevertheless, the bullish bias can only be confirmed if the index surpasses the 34,800-pt immediate resistance while forming a “higher high” bullish pattern. For now, we keep to our negative trading bias until the trailing-stop mark is triggered.

We advise traders to hold on to the short positions initiated at the closing level of 7 Jan, ie 36,107 pts. For risk management, the trailing-stop threshold is still at 34,800 pts.

The immediate support stays at 33,928 pts – 1 Dec 2021’s low – while the lower support is marked at 33,031 pts or 24 Jan’s low. The immediate resistance is pegged at 34,800 pts and followed by 35,430 pts, ie 19 Jan’s high.

Source: RHB Securities Research - 31 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024