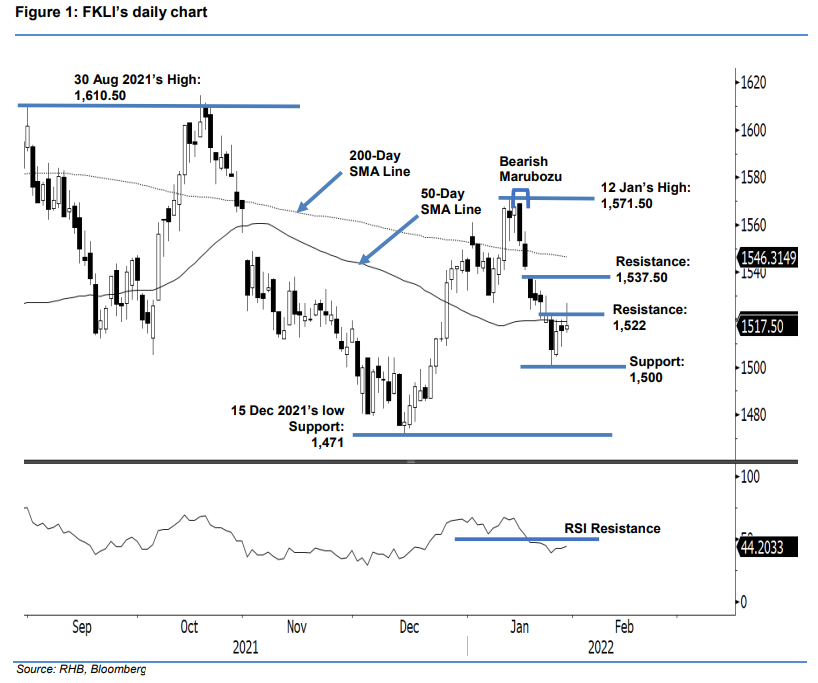

FKLI: Testing The 50-Day SMA Line Resistance

rhboskres

Publish date: Mon, 31 Jan 2022, 08:49 AM

Maintain short positions. The FKLI managed to recoup 2 pts to settle at 1,517.50 pts despite the 50-day SMA line blocking its rebound movement. Last Friday, the benchmark index began at 1,516 pts. It then surged on strong momentum when the morning session started off, testing the day’s high at 1,527 pts. The bears seized the intraday high, which saw the index retracing throughout the remaining session. It bounced off the intraday low of 1,514.50 pts and closed at 1,517.50 pts. Since setting a foothold at the 1,500-pt level, the index has been moving upwards. Expect it to continue facing strong selling pressure near the 50-day SMA line. Although it may extend the technical rebound if manages to cross above the 50-day SMA line, with the RSI still below the 50% threshold, it is more likely to retrace lower for consolidation before retesting the moving average line. For now, we retain our negative trading bias until the stop-loss has been breached.

Traders are recommended to hold on to the short positions initiated at 1,542.50 pts, or the close of 17 Jan. To minimise the trading risks, the trailing-stop is revised to 1,527 pts from 1,538 pts.

The immediate support remains at the 1,500-pt psychological mark, followed by 1,471 pts, which was the low of 15 Dec 2021. The first resistance is kept at 1,522 pts – 25 Jan’s high – followed by 1,537.50 pts, or the high of 19 Jan.

Source: RHB Securities Research - 31 Jan 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024