COMEX Gold: Reclaiming the USD1,800 Psychological Mark

rhboskres

Publish date: Thu, 03 Feb 2022, 06:07 PM

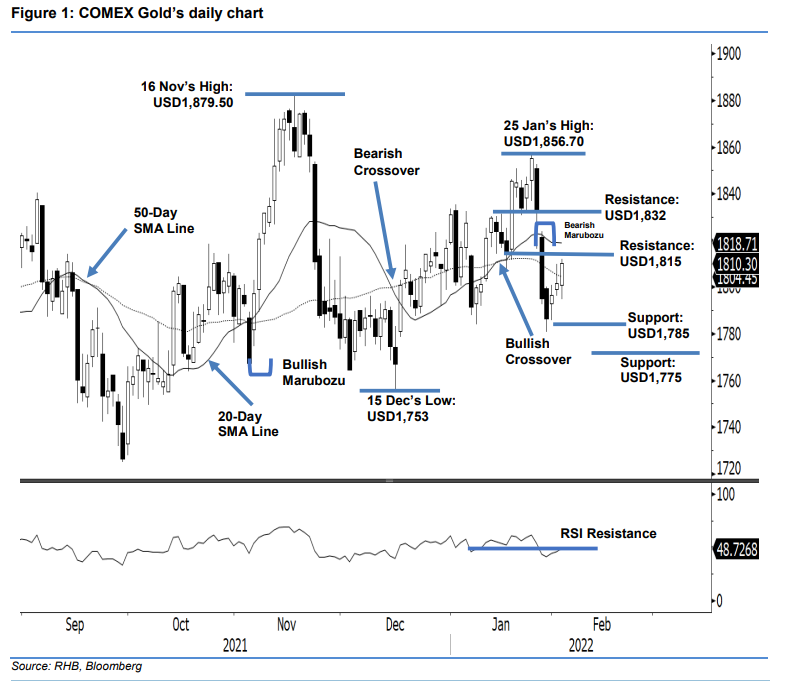

Maintain long positions. After falling for three consecutive sessions, the COMEX Gold found its interim base at USD1,780.60 on 28 Jan. It climbed USD8.80 yesterday to settle at USD1,810.30 – above the USD1,800 mark. The precious metal started off at USD1800.80. After touching the USD1,794.60 intraday low, it rose on positive momentum, testing the USD1,812 intraday high before the close. The price action showed that strong support exists near the USD1,785 level. With the renewed momentum, the commodity may attempt to test its immediate resistance at USD1,815. Crossing above the overhead threshold will reactivate the Bullish Crossover technical signal. This may thrust the commodity towards the higher resistance level at USD1,832. Otherwise, it is likely to consolidate sideways above the USD1,785 support level. For now, we maintain our positive trading bias.

We advise traders to retain the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To manage downside risks, the initial stop-loss threshold is fixed at USD1,775.

The immediate support stays at USD1,785, followed by USD1,775. Meanwhile, the immediate resistance is eyed at USD1,815, and the subsequent resistance at USD1,832, or the close of 26 Jan.

Source: RHB Securities Research - 3 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024