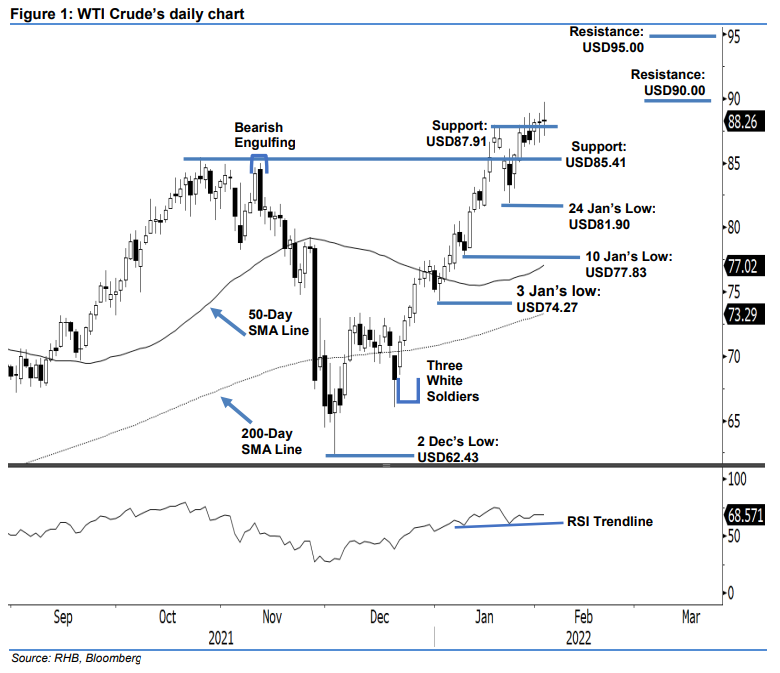

WTI Crude: Surpassing the USD87.91 Resistance

rhboskres

Publish date: Thu, 03 Feb 2022, 06:08 PM

Maintain long positions. The WTI Crude closed mildly positive yesterday despite strong intraday profit-taking, as it gained USD0.06 to USD88.26, ie above the USD87.91 previous resistance. The black gold opened at USD88.35 and then oscillated in a sideways direction before strong buying interest emerged ahead of the US trading session, where it hit the USD89.72 intraday high. However, strong selling pressure appeared from the top to drag the WTI Crude towards the USD87.10 day low before it rebounded moderately towards the close – reclaiming slightly above the opening level. The latest neutral candlestick above the immediate support level suggests the “higher high” bullish structure was drawn to retain the upward bias in the medium term. Coupled with a strong RSI nearing towards the 70% level, we still expect the bullish bias to remain in the medium term. Hence, we stick to our positive trading bias.

We recommend traders keep to the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. For risk management, the trailing-stop threshold is revised higher to USD85.41.

The immediate support is pegged at USD87.91 – 19 Jan’s high – and followed by USD85.41, which was 25 Oct 2021’s high. Conversely, the immediate resistance is at the USD90.00 mark and followed by USD95.00.

Source: RHB Securities Research - 3 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024