FCPO: Profit Taking Continues

rhboskres

Publish date: Fri, 04 Feb 2022, 10:14 AM

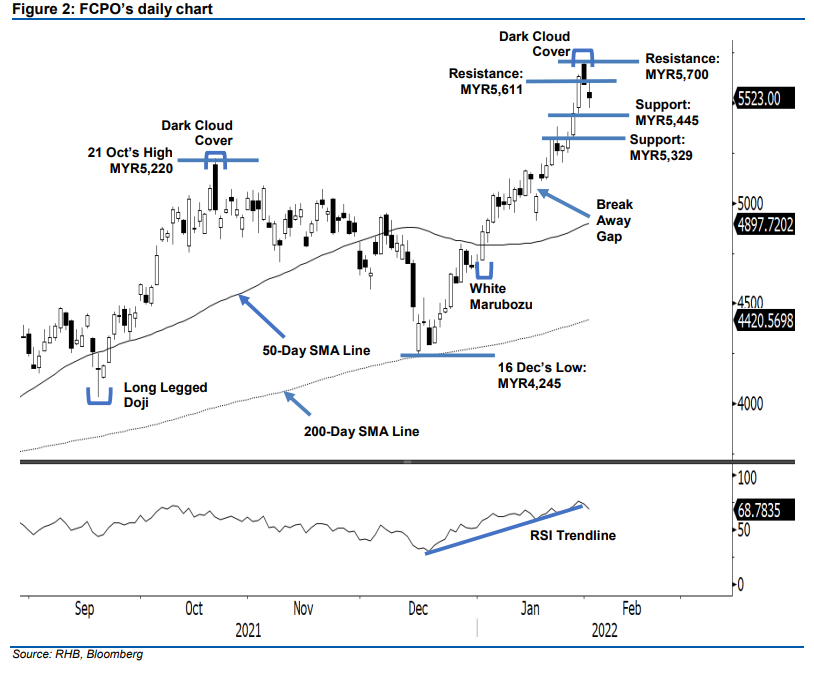

Maintain long positions. The FCPO experienced a second consecutive session of profit taking, retracing 79 pts to settle at MYR5,513. On the first trading session after the holiday, the commodity gapped down and opened lower at MYR5,549. After the weak opening, it osciallted between MYR5,611 and MYR5,471 before closing at MYR5,513. The latest session’s price action confirmed the bearish formation of a Dark Cloud Cover – the upside movement that started from the Breakaway Gap may be peaking at the strong resistance formed at MYR5,700. If the commodity breaches below MYR5,445, it may form a “lower low” bearish pattern and then attract further selling pressure ahead. However, the bulls may not easily give up the immediate threshold or support. While keeping our positive trading bias for now, we have tightened the trailing-stop.

Traders should hold on to the long positions initiated at MYR4,649, or the close of 24 Dec 2021. To protect the downside risks, the trailing-stop threshold is adjusted higher to MYR5,445, from MYR5,300.

The immediate support remains at MYR5,445 – 28 Jan’s low – followed by the lower support of MYR5,329 ie the low of 27 Jan. Meanwhile, the immediate resistance has changed to MYR5,611 (3 Feb’s high), followed by MYR5,700, or the high of 31 Jan.

Source: RHB Securities Research - 3 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024