FKLI: Crossing Above The 50-Day SMA Line

rhboskres

Publish date: Fri, 04 Feb 2022, 10:13 AM

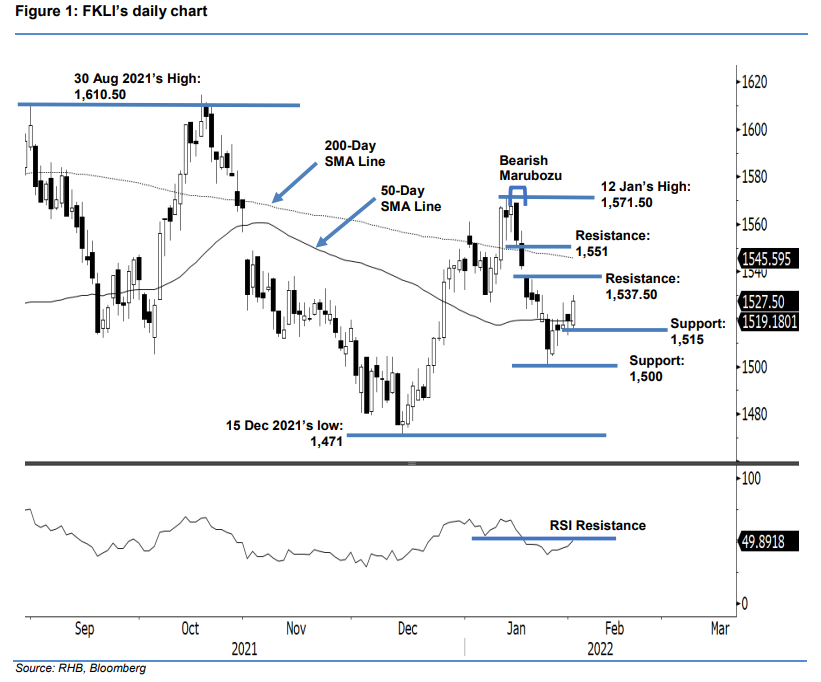

Trailing-stop triggered; initiate long positions. The FKLI’s February futures contract surged on the back of strong demand, jumping 17.50 pts to settle at 1,527.50 pts. Recall that the February futures contract closed at 1,510 pts on Monday – gapping up and opening at 1,517.50 pts during Thursday’s session. After touching the intraday low of 1,515 pts, it climbed higher to test the intraday high of 1,530 pts before the close. The latest price action saw the index reclaim the 50-day SMA line. It also broke past the previous resistance of the1,527-pt level to form a fresh “higher high” bullish pattern. Coupled with the RSI indicator curving upwards lately, the bullish momentum is gaining traction to lift the index higher. If it sustains above the 1,515-pt immediate support, the index may scale higher to test the 1,537.50-pt resistance. As the trailing-stop has been breached, we shift over to a positive trading bias.

We closed out the short positions, which initiated at 1,542.50 pts, or the close of 17 Jan after the trailing-stop at 1,527 pts was breached. Conversely, initiate long positions at the closing of 3 Feb, ie 1,527.50 pts. To minimise the trading risks, the initial stop-loss is set at 1,500 pts.

The immediate support is revised higher to 1,515 pts – 3 Feb’s low – followed by the 1,500-pt psychological mark. Towards the upside, the nearest resistance is eyed at 1,537.50 pts – 19 Jan’s high – followed by 1,551 pts, or the low of 14 Jan.

Source: RHB Securities Research - 4 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024