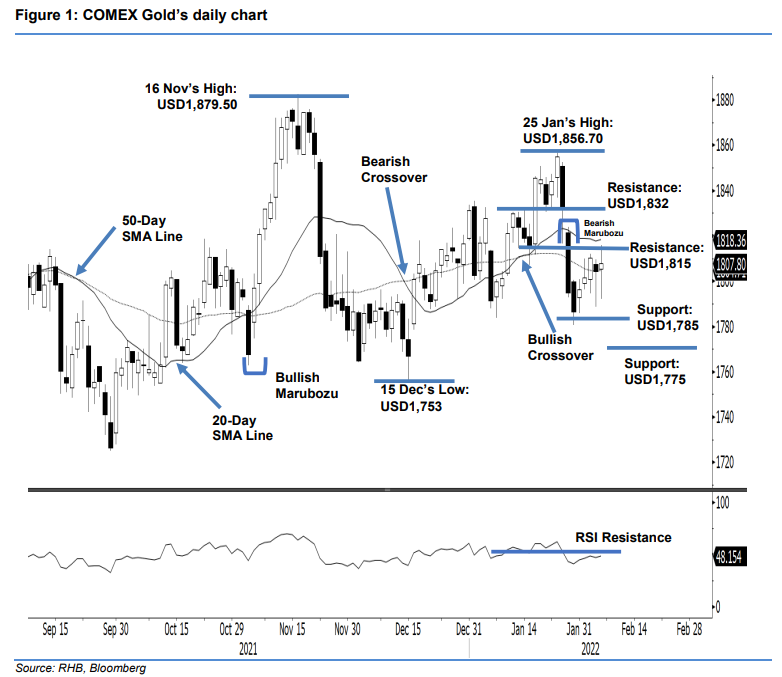

COMEX Gold : Eyeing the 20-Day SMA Line Resistance

rhboskres

Publish date: Mon, 07 Feb 2022, 09:19 AM

Maintain long positions. The COMEX Gold managed to stay above the 50-day SMA line despite another round of selling pressure. It rose USD3.70 to settle Friday’s session at USD1,807.80. The commodity started off at USD1,805.40. After touching the USD1,815.80 intraday high, strong profit-taking dragged it to the session’s low of USD1,792.10. The bulls then seized the intraday low during the US trading session, lifting it to close in positive territory – while printing a candlestick with long lower shadow. The price action showed that the yellow metal was able to print a fresh “higher low” bullish candlestick, indicating that the bulls are still in control of the recent trend. Closing above the 50-day SMA line also reaffirms that the Bullish Crossover of the two moving average lines remains valid. With the strong downside support, the commodity may continue to climb and test the 20-day SMA line. For now, we hold on to our positive trading bias.

We advise traders to maintain the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To mitigate trading risks, the initial stop-loss threshold is placed at USD1,775.

The immediate support stays at USD1,785, followed by the USD1,775 whole number. On the upside, the immediate resistance is pegged at USD1,815, followed by the higher hurdle at USD1,832, or the close of 26 Jan.

Source: RHB Securities Research - 7 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024