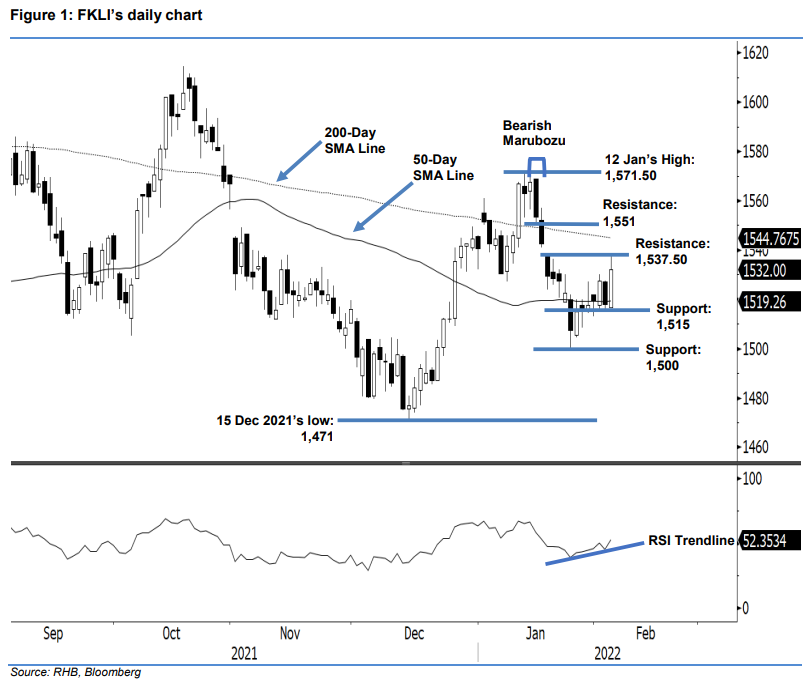

FKLI: Bouncing Off The 50-Day SMA Line

rhboskres

Publish date: Tue, 08 Feb 2022, 04:58 PM

Maintain long positions. The FKLI rebounded yesterday following recent profit-taking activities, adding 14 pts to settle stronger at 1,532 pts. The benchmark index initially started off Monday’s session at 1,516.50 pts and jumped off to hit the day’s high of 1,538.50 pts before sliding sideways towards the close. The FKLI charted a bullish candlestick – with an upper shadow hitting the immediate resistance – that suggests it managed to bounce above the 1,515-pt support. Hence, the index remains on track for the “higher low” bullish formation. With the RSI leading indicator pointing higher above the 50% level, this indicates the FKLI is poised to jump higher towards breaching the 1,537.50-pt immediate resistance in the coming sessions. As such, we maintain our positive trading bias until the stop-loss point is breached.

We recommend traders maintain the long positions initiated at 1,527.50 pts or the closing of 3 Feb. To mitigate the downside risks, the initial stop-loss threshold is revised higher to 1,508 pts from 1,500 pts.

The immediate support is marked at 1,515 pts – 3 Feb’s low – and followed by the 1,500-pt psychological mark. On the upside, the immediate resistance is set at 1,537.50 pts – 19 Jan’s high – and followed by 1,551 pts, which was the low of 14 Jan.

Source: RHB Securities Research - 7 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024