WTI Crude: a Pullback for Consolidation

rhboskres

Publish date: Wed, 09 Feb 2022, 08:39 AM

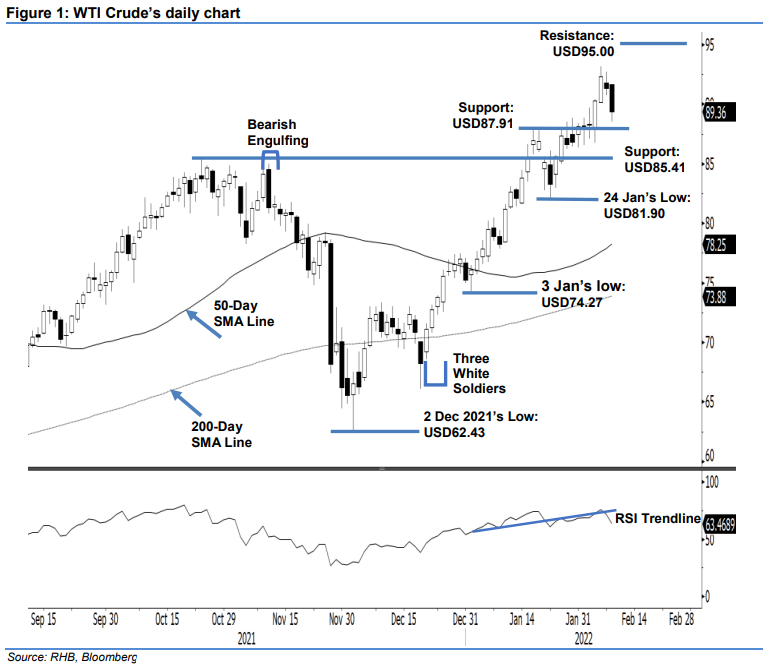

Maintain long positions. The WTI Crude continued to experience profit-taking for the second consecutive session, retreating USD1.96 to settle at USD89.36. On Tuesday, the commodity opened at USD91.64. After touching the session’s high of USD91.68, it moved lower throughout the session, reaching the session’s USD88.51 low before closing at USD89.36. Despite the pullback, the WTI Crude managed to stay above the critical support level of USD85.41. Note that yesterday’s low of USD88.51 was also higher than 3 Feb’s low of USD86.75. As such, we think the bulls are still in control of the recent trend. The commodity is merely undergoing a healthy pullback to consolidate near the USD90.00 level. Bullish momentum may pick up again once the consolidation is over. As such, we stick to our bullish trading bias.

We advise traders to keep the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To mitigate downside risks, the trailing-stop is placed at USD85.41 – the high of 25 Oct 2021.

The immediate support is revised to USD87.91 – 19 Jan’s high – followed by USD85.41. Conversely, the immediate resistance is pegged at USD95.00, followed by the USD100.00 psychological point.

Source: RHB Securities Research - 9 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024