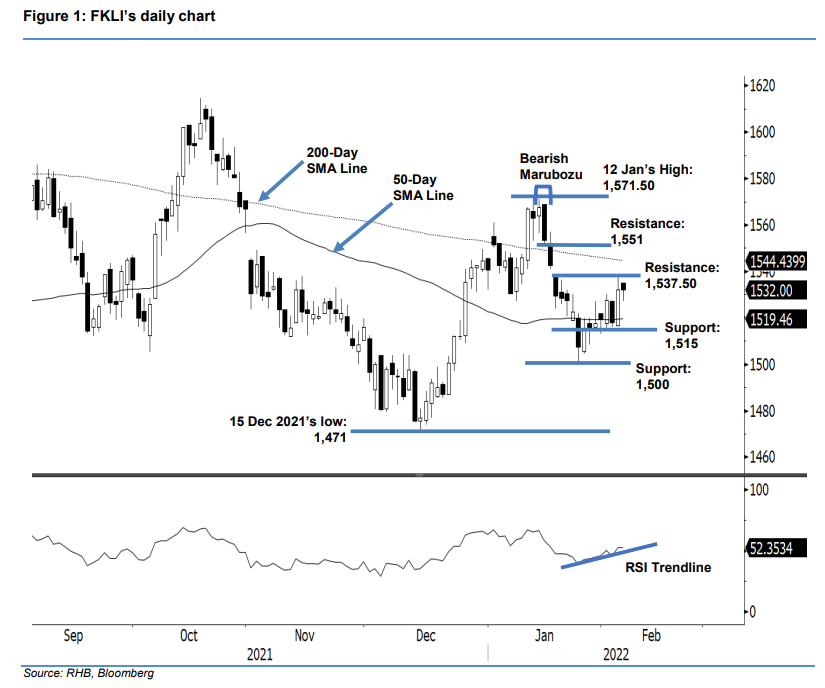

FKLI: Mild Consolidation Below Immediate Resistance

rhboskres

Publish date: Wed, 09 Feb 2022, 08:39 AM

Maintain long positions. Despite opening on a positive note, the FKLI hesitated over crossing above the immediate resistance. After a strong opening at 1,535 pts, the index pulled back and closed unchanged at 1,532 pts, charting a bearish candlestick but with a long lower shadow (the day’s low was 1,527 pts). The price action suggests that the bulls attempted to fend off selling pressure. As long as it remains above the 50-day SMA line, sentiment should improve in the coming sessions, and lead to the momentum picking up again. As the RSI is still above the 50% threshold – indicating that the bullish momentum is still in play – we make no change to our positive trading bias.

Traders should stick to the long positions initiated at 1,527.50 pts or the closing of 3 Feb. To protect the downside risks, the initial stop-loss threshold is set at 1,508 pts.

The immediate support remains at 1,515 pts – 3 Feb’s low – followed by the 1,500-pt psychological mark. On the other hand, the immediate resistance is at 1,537.50 pts – 19 Jan’s high – followed by 1,551 pts or the low of 14 Jan.

Source: RHB Securities Research - 8 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024