FCPO: Strong Negative Momentum Kicks In

rhboskres

Publish date: Wed, 09 Feb 2022, 08:40 AM

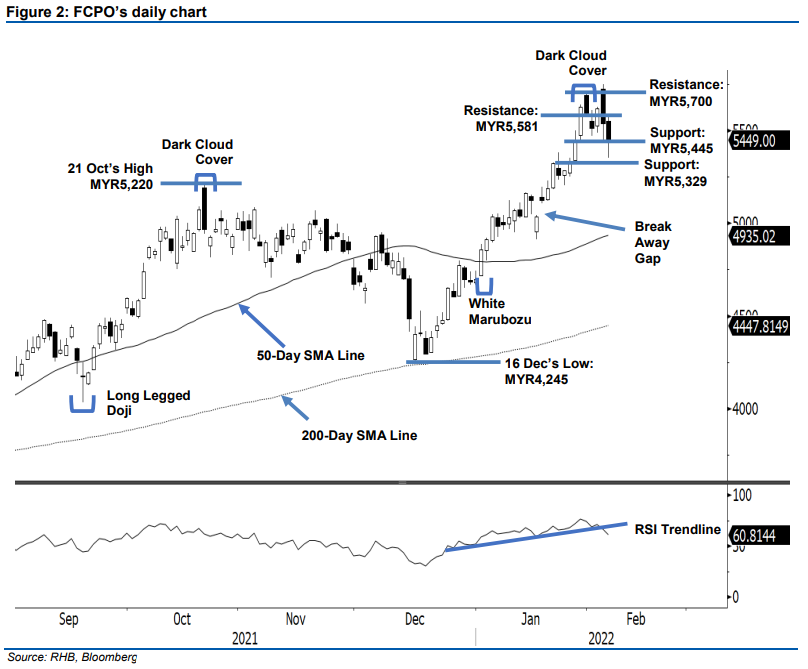

Maintain long positions. Following a rejection at the MYR5,700 resistance point, the FCPO continued to move lower for a second consecutive session. It fell MYR87.00 on Tuesday to settle at MYR5,449. The commodity opened at MYR5,552. Amidst negative sentiment, it gapped down in the morning and retreated towards the day’s low of MYR5,351. After moving sideways near the day’s low most of the time, it rebounded to reclaim the MYR5,445 support before closing. The latest candlestick with a long lower shadow saw the commodity reacting positively at the MYR5,445 support level – which implies that the bulls are not ready to give up yet. However, the weak closing also suggest that the Dark Cloud Cover bearish reversal signal is taking a toll on the upside movement, with a stiff resistance at MYR5,700. If the negative momentum follows through, the FCPO may breach the immediate support and undergo a correction towards the next support of MYR5,329. Since the immediate support is still intact, we are cautiously optimisitic and maintain a positive trading bias.

We recommend that traders stick to long positions initiated at MYR4,649 or the close of 24 Dec 2021. To manage the downside risks, the trailing-stop is set at MYR5,445.

The immediate support remains at MYR5,445 – 28 Jan’s low – followed by MYR5,329 or the low of 27 Jan. Meanwhile, the first resistance is pegged at MYR5,581 – 8 Feb’s high –followed by MYR5,700 ie the high of 31 Jan.

Source: RHB Securities Research - 9 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024