WTI Crude: Remaining Sideways Above the Immediate Support

rhboskres

Publish date: Thu, 10 Feb 2022, 05:30 PM

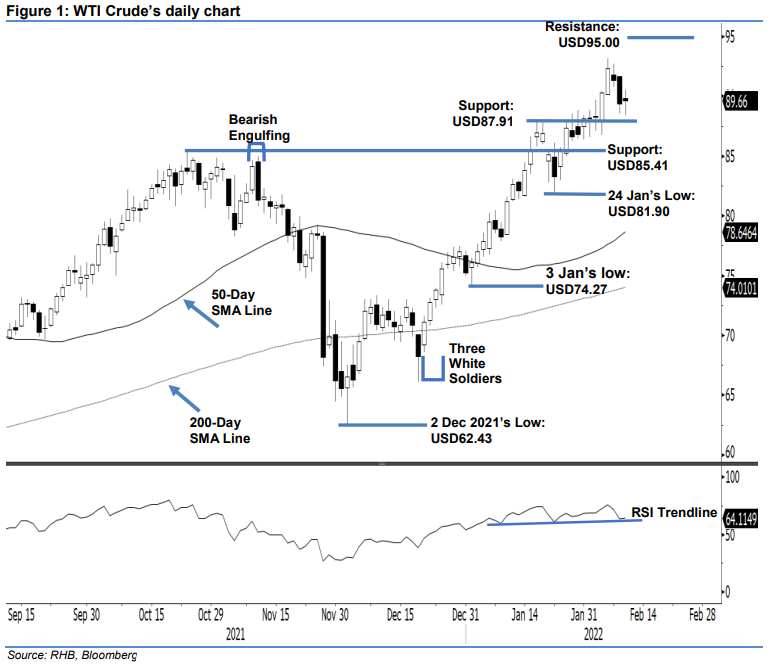

Maintain long positions. The WTI Crude slid in a sideways direction yesterday following the recent pullback – it closed just USD0.30 higher at USD89.66. The commodity opened at USD89.86 and oscillated between the USD88.41 day low and USD90.58 day high throughout the session. Strong selling pressure emerged during the mid-US trading session to drag the WTI Crude from the top to retrace lower and close at slightly below the opening level. The neutral candlestick formed yesterday above the immediate support of USD87.91, which implies the commodity is experiencing a mild pullback while remaining bullish in the medium term. We expect the buying pressure near the immediate support to uplift the WTI Crude to rebound higher. As such, we stick to our bullish trading bias.

We advise traders to keep to the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To mitigate downside risks, the trailing-stop mark is placed at USD85.41, ie the high of 25 Oct 2021.

The immediate support is revised to USD87.91 – 19 Jan’s high – and followed by USD85.41. Conversely, the immediate resistance is pegged at USD95.00 and followed by the USD100.00 psychological point.

Source: RHB Securities Research - 10 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024