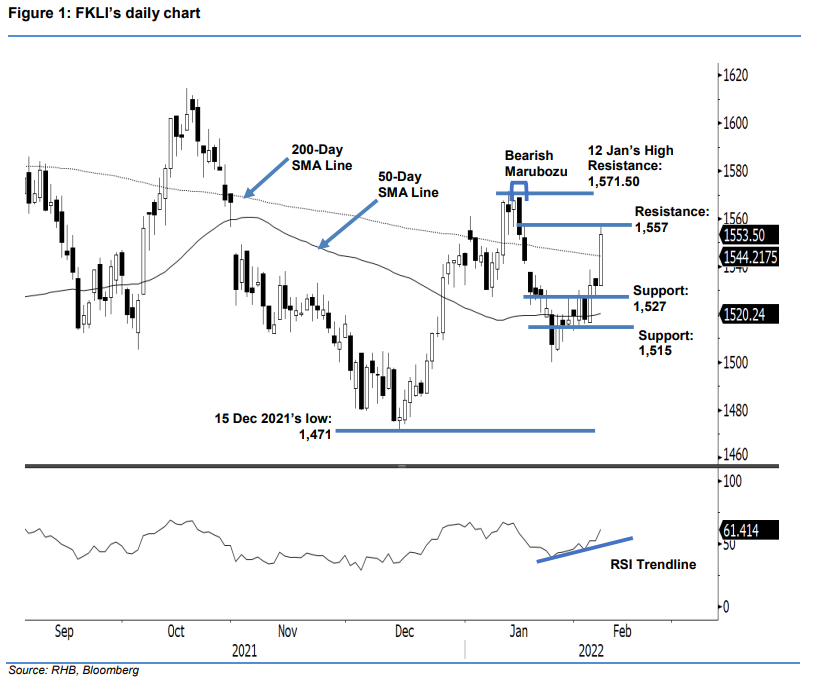

FKLI: Reclaiming The 200-Day SMA Line

rhboskres

Publish date: Thu, 10 Feb 2022, 05:33 PM

Maintain long positions. After a mild consolidation, bullish momentum on the FKLI ramped up again, and the index gained 21.5 pts to close at 1,553.50 pts yesterday – breaching the 1,537.50 resistance. The benchmark index initially opened flat at 1,532 pts. Encouraged by its US peers overnight, the FKLI jumped when the morning session started off, and printed the day’s high of 1,557 pts before closing. The latest bullish candlestick saw the index crossing above the 200-day SMA line. This is the fifth time since 26 Aug 2020 that it crossed above the long-term moving average. If the index stays above the moving average line, it may continue to climb higher and test YTD high of 1,571.50 pts. Otherwise, retracing below the moving average line would lead to sentiment turning cautious again. For now, we maintain a positive trading bias.

We recommend that traders to hold on long positions initiated at 1,527.50 pts or the close of 3 Feb. To minimise the downside risks, the stop-loss has been adjusted higher to 1,515 pts from 1,508 pts.

The immediate support is now at 1,527 pts – 8 Feb’s low – then 1,515 pts or the low of 3 Feb. Conversely, the immediate resistance is pegged at 1,557 pts or 17 Jan’s high, followed by 1,571.50 pts (the YTD high).

Source: RHB Securities Research - 10 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024