FCPO: Immediate Resistance Hampers Uptrend

rhboskres

Publish date: Fri, 11 Feb 2022, 05:49 PM

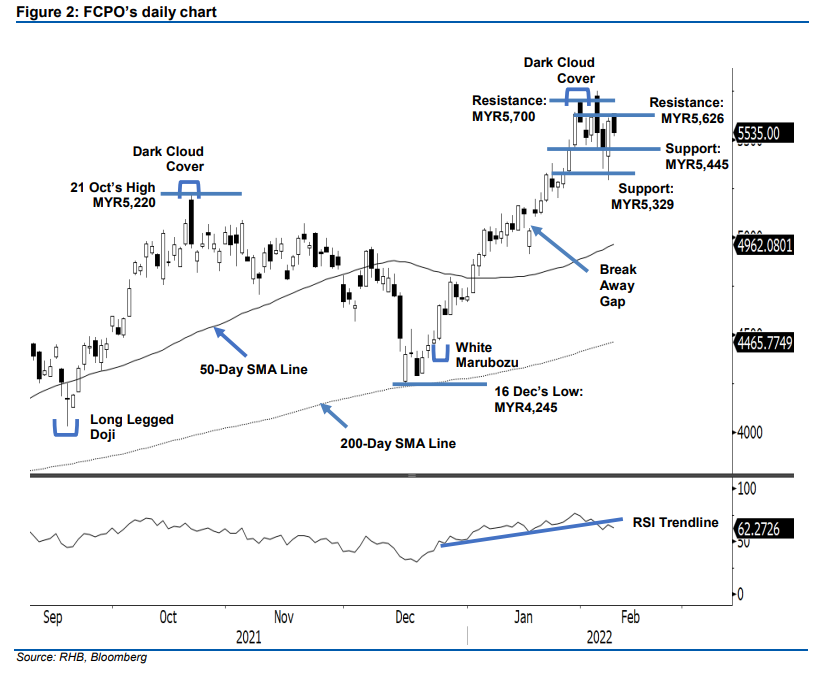

Maintain long positions. The bulls took a breather near the immediate resistance and the FCPO retracing MYR59.00 and closed at MYR5,535. After a strong rebound on Wednesday, it opened at MYR5,631, with a gap-up. The commodity failed to sustain the strong opening, and fell to the session’s low of MYR5,514 then trended sideways for the rest of the session. The bearish candlestick indicates that sentiment has turned cautious again. If the commodity corrects downwards and drops below the MYR5,445 support, selling pressure may intensify – dragging the FCPO towards the next support of MYR5,329. On the other hand, breaking past the MR5,626 resistance may see the sentiment improving and attracting more bulls. The RSI indicator fell below the trendline but still remains above the 50% threshold – so it is very likely that the FCPO will be moving sideways in the coming sessions. Pending a breakout of the either boundary of the immediate resistance or support, we make no change to our positive trading bias.

Traders should remain in long positions initiated at MYR4,649 or the close of 24 Dec 2021. To manage the downside risks, the trailing-stop is placed at MYR5,445.

The nearest support stays at MYR5,445 (28 Jan’s low), followed by MYR5,329 or the low of 27 Jan. Conversely, the immediate resistance is pegged at MYR5,626 – 4 Feb’s high – followed by MYR5,700 or the high of 31 Jan.

Source: RHB Securities Research - 11 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024