FKLI: Taking a Pause Near The YTD High

rhboskres

Publish date: Fri, 11 Feb 2022, 05:49 PM

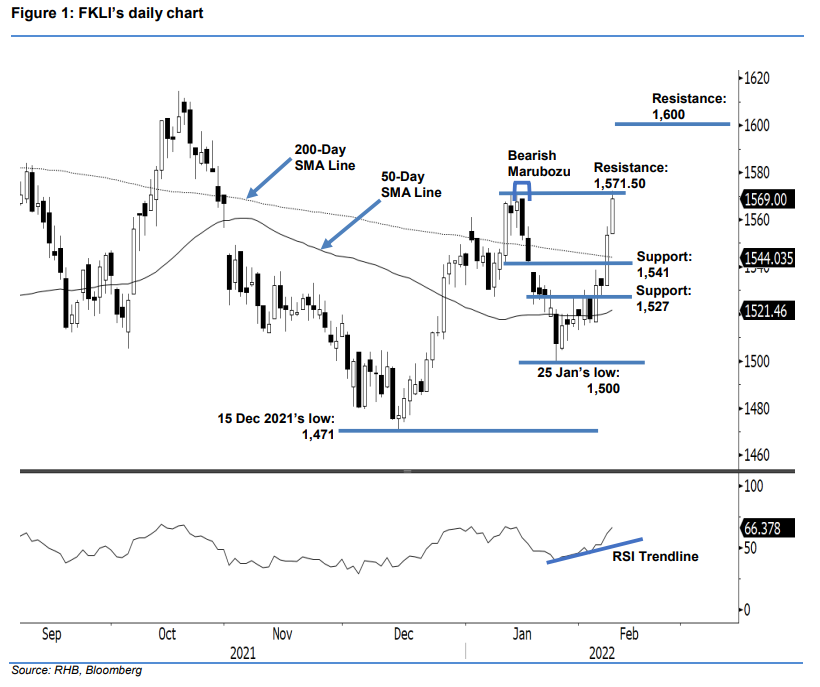

Maintain long positions. After crossing above the 200-day SMA line, the FKLI’s bullish momentum picked up yesterday, lifting the index by 15.50 pts to close at 1,569 pts. The benchmark index opened at 1,554 pts. Sentiment turned positive again when the morning session began, and the index jumped then progressed upwards. It closed near the day’s high of 1,572 pts, thereby printing a long white candlestick. Despite the index climbing higher on strong momentum, the bulls hesitated to cross above the 1,571.50-pt resistance (also the YTD high). If it manages to cross the immediate threshold, the bulls may set sights on the psychological mark of 1,600 pts. Since the index has rallied non-stop from the 1,500-pt level, it may retrace in the coming sessions towards a consolidation. If the bears start to take profit, we expect the 200-day SMA line to provide a strong support. With the bulls still in control, we make no change to our positive trading bias.

We advise traders to stick with long positions initiated at 1,527.50 pts or the close of 3 Feb. To protect the downside risks, the stop-loss has been adjusted higher to 1,535 pts from 1,515 pts. The immediate support is now higher, at 1,541 pts – 17 Jan’s low – then 1,527 pts or the low of 8 Feb.

The immediate resistance is pegged at 1,571.50 pts (12 Jan’s high), followed by 1,600 pts (the new high).

Source: RHB Securities Research - 11 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024