WTI Crude: Consolidating Sideways Near USD90.00

rhboskres

Publish date: Fri, 11 Feb 2022, 05:50 PM

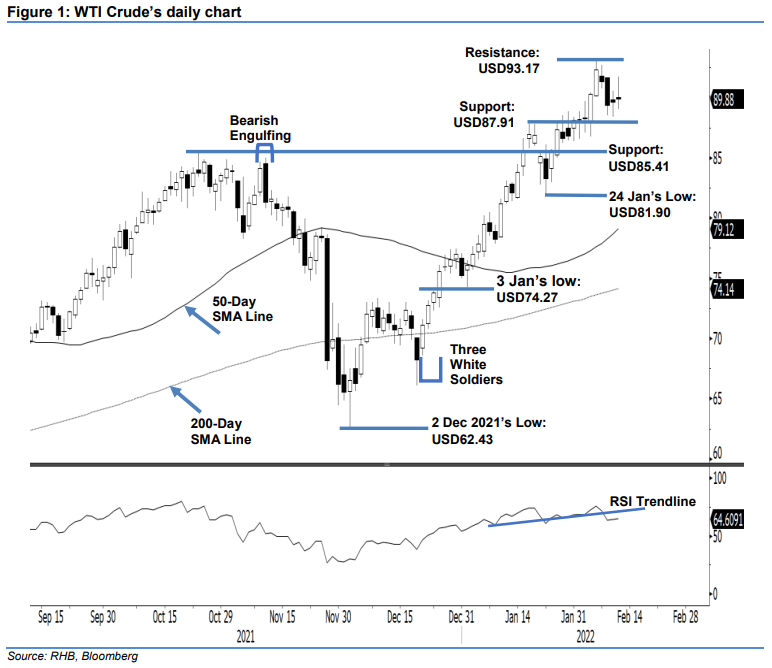

Maintain long positions. The WTI Crude continued to consolidate sideways yesterday, after recouping USD0.22 to settle at USD89.88. The commodity started Thursday’s session at USD90.01. Volatility picked up during the US session, where it rebounded from the intraday low of USD89.03 to the day’s high of USD91.74. Bullish momentum failed to sustain, and the commodity gave up most of its intraday gains to close at USD89.88. Despite keeping its position above the immediate support – showing that the bulls are in control – the bears attempted to take profit on the rally. This capped the upside movement at the USD93.17 resistance level. In the coming sessions, the WTI Crude is likely to consolidate between the USD87.91 support and USD93.17 resistance levels. Momentum may pick up once it breaks past either one of these thresholds. Pending the breakout, we keep our bullish trading bias.

Traders are recommended to maintain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage the trading risks, the trailing-stop is set at USD85.41, or the high of 25 Oct 2021.

The immediate support is marked at USD87.91 – 19 Jan’s high – followed by USD85.41. Meanwhile, the first resistance is pegged at USD93.17 (4 Feb’s high), followed by the USD95.00 whole number.

Source: RHB Securities Research - 11 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024