COMEX Gold: Bullish Momentum Accelerates

rhboskres

Publish date: Mon, 14 Feb 2022, 08:30 AM

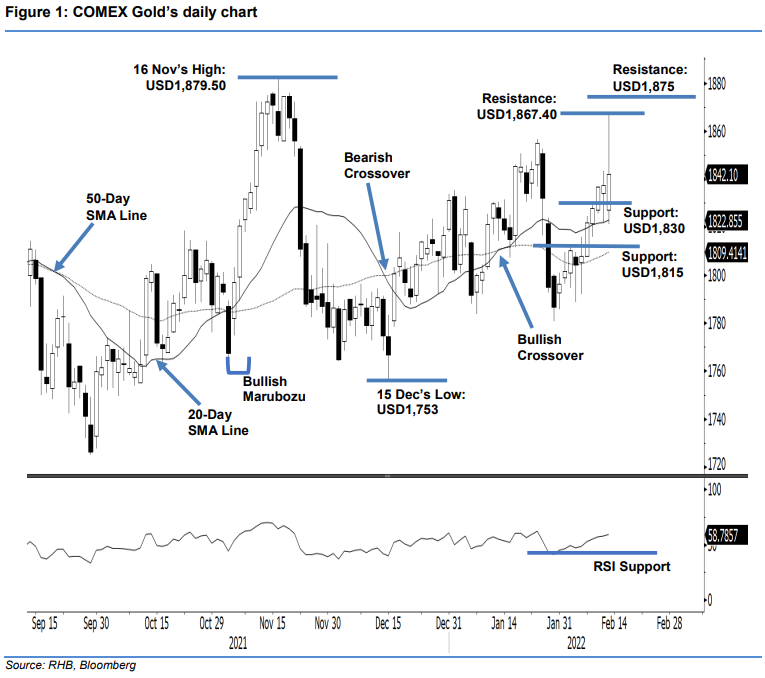

Maintain long positions. The COMEX Gold saw strong demand on Friday, rising USD4.70 to settle at USD1,842.10. The commodity opened lower at USD1,827 and continued to move down to the session’s low of USD1,821.10 during the European trading session. Bullish momentum picked up from the intraday low, accelerating the commodity towards the session’s high of USD1,867.40 before the close. Amidst strong demand, the COMEX Gold’s upside momentum may follow through in coming sessions, to retest the USD1,867.40 resistance level. A breach of the immediate threshold would see the commodity travel towards the higher resistance pegged at USD1,875. Meanwhile, the RSI indicator is pointing upwards, indicating that bullish momentum is in play. With the bulls firmly in control, we keep our positive trading bias.

Traders should stay with the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To manage downside risks, the stop-loss is adjusted higher to USD1,812 from USD1,785.

The first support is marked at USD1,830, followed by the USD1,815 whole number. Conversely, the immediate resistance is seen at USD1,867.40 – 11 Feb’s high – followed by USD1,875.

Source: RHB Securities Research - 14 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024