FKLI: Bullish Structure Intact Despite Mild Profit-Taking

rhboskres

Publish date: Mon, 14 Feb 2022, 08:46 AM

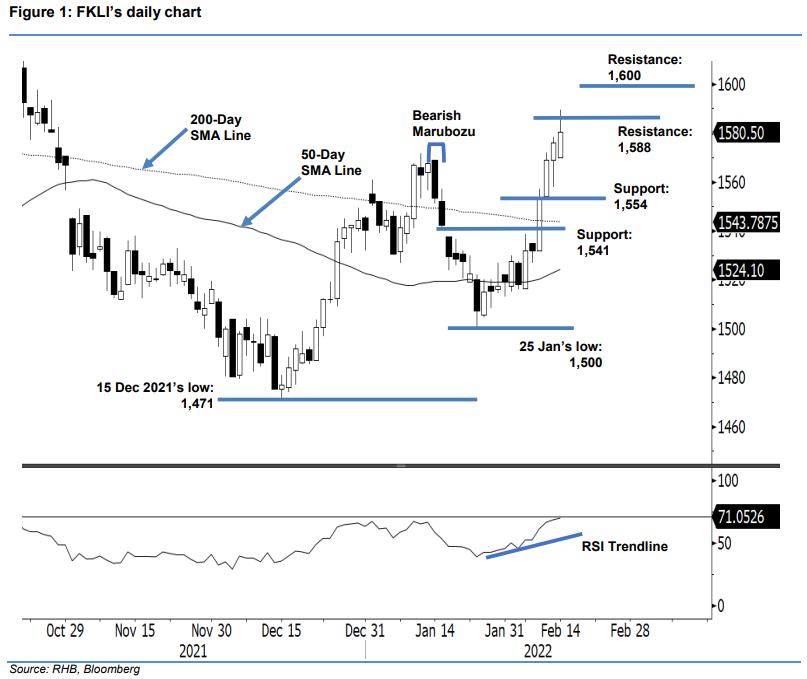

Maintain long positions. The FKLI edged upwards on Monday, despite mild profit-taking activities kicking in near the 1,588-pt resistance. It opened at 1,570 pts, established the intraday low of 1,569.50 pts, then jumped to test the day’s high of 1,589.50 pts. The uptrend came to a stop at the immediate resistance, as shown by the candlestick with a long upper shadow. Meanwhile, the white body candlestick, or a strong closing being higher than the opening, reaffirms that the bulls were still dominating the session. This, on top of the index continuing to print a fresh “higher low”, compels us to maintain that the strong positive momentum may lift the index above the immediate resistance. On the other hand, if the momentum loses steam, the FKLI may retrace towards the 200-day SMA line. We will stick to a positive trading bias until the trailing-stop is triggered.

We recommend traders to maintain the long positions initiated at 1,527.50 pts, or the close of 3 Feb. To protect the trading risks, trailing-stop is fixed at 1,541 pts.

The immediate support is at 1,554 pts – 10 Feb’s low – followed by 1,541 pts or the low of 17 Jan. Meanwhile, the immediate resistance is pegged at 1,588 pts whole number and then 1,600 pts.

Source: RHB Securities Research - 14 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024