FCPO: Eyeing To Breach Past The New High

rhboskres

Publish date: Mon, 14 Feb 2022, 08:46 AM

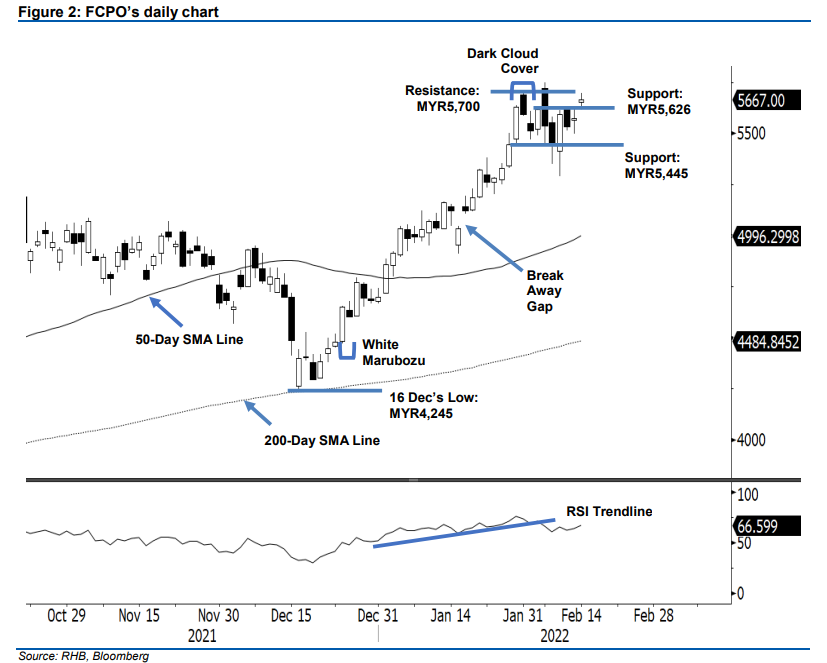

Maintain long positions. The FCPO resumed its upward momentum yesterday, rising MYR94.00 to close at MYR5,667. The commodity opened with a gap-up, at MYR5,655. After oscillating between MYR5,697 and MYR5,616, it closed higher than the opening level. The latest price action shows that the bulls have a technical advantage over the bears, by printing a fresh “higher low” bullish pattern and breaking past the previous resistance of MYR5,626 to form a fresh “higher high”. If the commodity continues to trade above the MYR5,626 resistance-turned-support, it may continue to scale higher – breaking past the MYR5,700 pyschological level and recording a new high. In the event the commodity turns towards a pullback for the immediate session (Tuesday will be the last trading session before traders roll over the futures contract on 16 Feb), we expect MYR5,445 to act as a strong downside buffer. Since the bullish momentum is still in play, we maintain our positive trading bias.

Traders should remain in the long positions initiated at MYR4,649 or the close of 24 Dec 2021. To manage the downside risks, the trailing-stop is set at MYR5,445.

The immediate support has shifted to MYR5,626 (4 Feb’s high), followed by MYR5,445 or the low of 28 Jan. Conversely, the nearest resistance is now at MYR5,700 – 31 Jan’s high – followed by MYR5,840 – which is in uncharted territory.

Source: RHB Securities Research - 14 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024