COMEX Gold: Testing the 3-Month High

rhboskres

Publish date: Tue, 15 Feb 2022, 08:47 AM

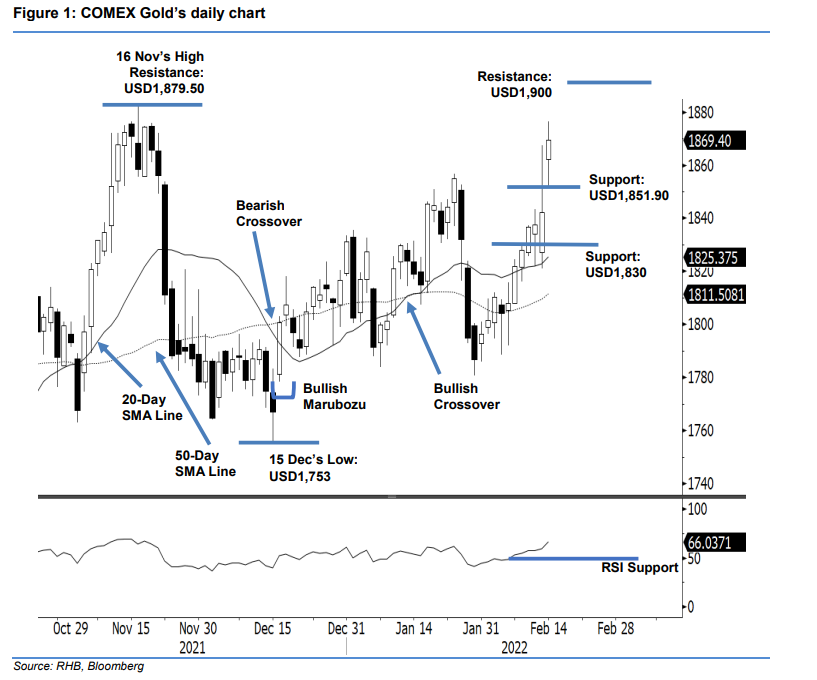

Maintain long positions. The COMEX Gold surged on Monday, on the back of strong demand, jumping USD27.30 to settle at USD1,869.40. The commodity opened stronger at USD1,862.20 and established its intraday low at USD1,851.90. Strong demand emerged during the US trading session, lifting the COMEX Gold to the day’s high of USD1,876.50 ahead of the close. The positive price action reaffirmed that the bulls are firmly gripping the commodity, and eyeing 16 Nov 2021’s 3-month high of USD1,879.50. If it breaches the immediate threshold, the commodity may travel towards the next psychological barrier at USD1,900. If it switches its direction to profit-taking, we believe strong support will be found near the USD1,850 level. As the bullish momentum is now at full speed, we hold on to our positive trading bias.

We recommend traders stick with the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To manage trading risks, the trailing-stop is introduced at USD1,830.

The immediate support is seen at USD1,851.90 – 14 Feb’s low – followed by the USD1,830 whole number. On the upside, the first resistance is at USD1,879.50 (16 Nov 2021’s high), followed by the USD1,900 psychological level.

Source: RHB Securities Research - 15 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024