FKLI: Bulls Are Still Driving The Market

rhboskres

Publish date: Tue, 15 Feb 2022, 08:49 AM

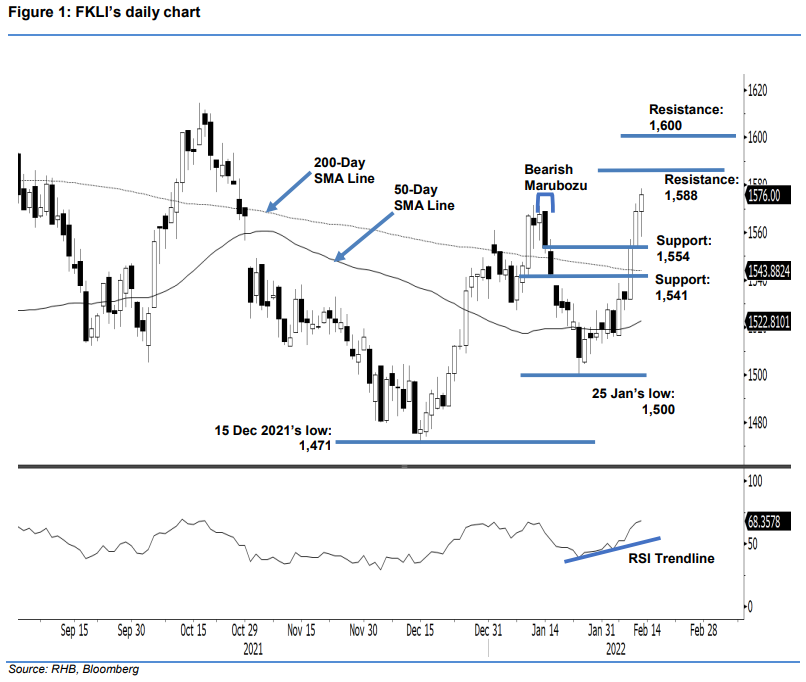

Maintain long positions. Bullish momentum on the FKLI was extended on Friday, lifting the index by another 7 pts to close at 1,576 pts – recording a new YTD high. The benchmark index opened at 1,569 pts and fell to the day’s low of 1,558 pts. After it found the intraday low during the morning session, the index trended north for the rest of the session, printing the day’s high of 1,578.50 pts before the close. The latest price action indicates that the uptrend has firmed up above the 200-day SMA line. As long as the FKLI remains above the long-term moving average line, the bullish structure should be regarded as intact. Meanwhile, if investors take profit and the index undergoes a retracement, the 200-day SMA line should provide strong support. Since the index printed a new high, the bulls are eyeing the 1,588-pt resistance, followed by 1,600 pts. For now, we hold on our positive trading bias.

Traders should maintain the long positions initiated at 1,527.50 pts, or the close of 3 Feb. To mitigate the downside risks, the stop-loss has been adjusted higher to 1,541 pts from 1,535 pts.

The immediate support is now at 1,554 pts – 10 Feb’s low – then 1,541 pts, or the low of 17 Jan. The immediate resistance is at 1,588 pts (25 Oct 2021’s close), followed by 1,600 pts.

Source: RHB Securities Research - 14 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024