FCPO: Trying To Breach The Immediate Resistance

rhboskres

Publish date: Tue, 15 Feb 2022, 08:50 AM

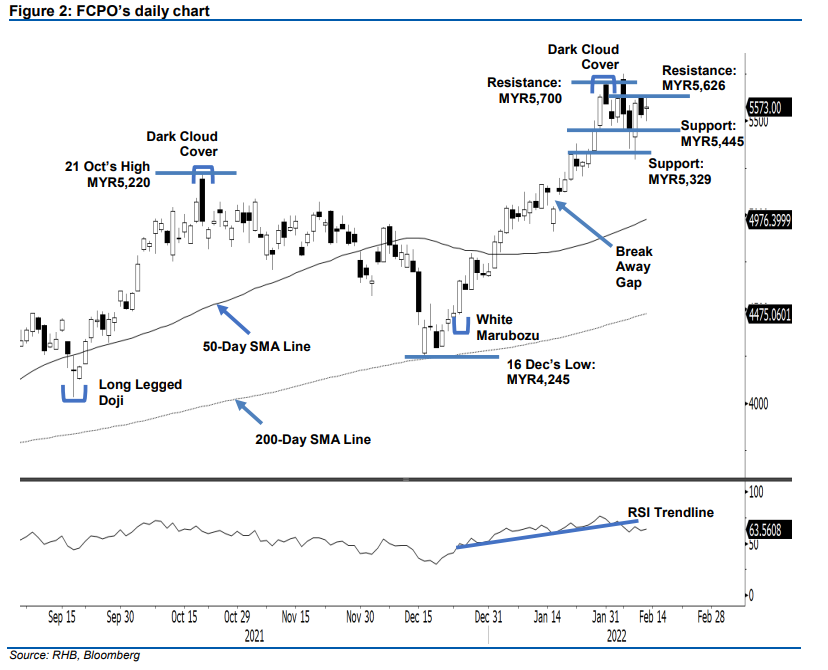

Maintain long positions. After the Malaysian Palm Oil Board released its January statistics, the FCPO reacted positively by rebounding MYR38.00 and closed at MYR5,573. The commodity opened at MYR5,564. Sentiment was shakier in the morning, and the commodity fell to the day’s low of MYR5,498. Buying pressure intensified near the day’s low and lifted the commodity to test the day’s high of MYR5,624 before the close. Based on price actions since 8 Feb, the lower shadow candlestick pattern indicates a strong support level has been formed at MYR5,445. As long as the FCPO continues to trade above the immediate support, the bulls may attempt to cross above the immediate resistance. Breaking the MYR5,626 threshold would see it travel towards the MYR5,700 resistance. For now, we believe the upside momentum remains intact, and stick with our positive trading bias.

Traders should remain in the long positions initiated at MYR4,649 or the close of 24 Dec 2021. To manage trading risks, the trailing-stop is fixed at MYR5,445.

The nearest support remains at MYR5,445 (28 Jan’s low), followed by MYR5,329 or the low of 27 Jan. Towards the upside, the immediate resistance is at MYR5,626 – 4 Feb’s high – followed by MYR5,700 or the high of 31 Jan.

Source: RHB Securities Research - 15 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024