FCPO: Upside Movement Capped At MYR5,700

rhboskres

Publish date: Wed, 16 Feb 2022, 05:36 PM

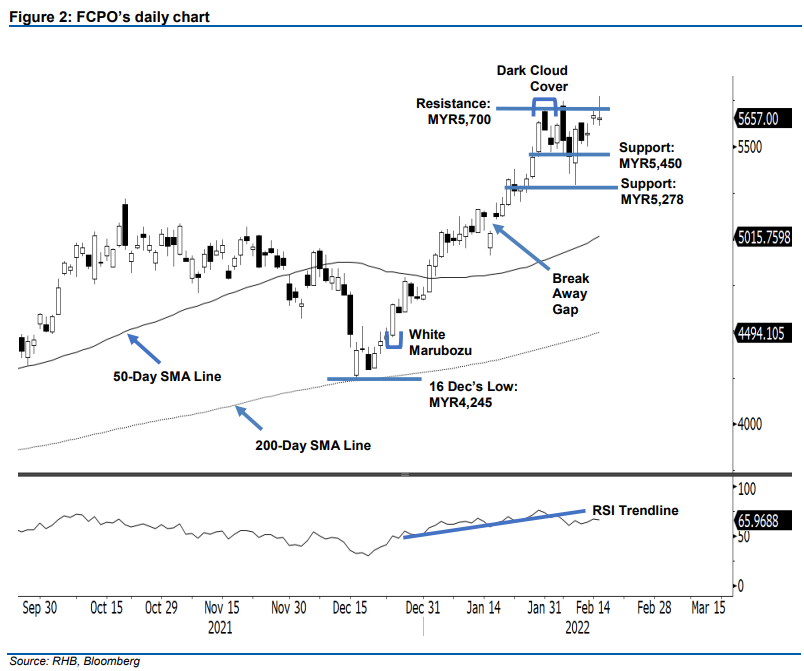

Maintain long positions. The FCPO Apr 2022 futures contract saw profit-taking above the MYR5,700 level. It retraced MYR10.00 from Monday’s session to close at MYR5,657. The commodity opened at MYR5,649 yesterday, then climbed higher in the morning to form the intraday high of MYR5,773. Strong profit-taking kicked in at the eleventh hour, dragging the commodity towards the day’s low of MYR5,612 before the close. As mentioned previously, we expect volatility to pick up due to the rollover of the futures contract. Since the May futures contract last traded at MYR5,474, presents a gap from the closing pricec of April’s futures contract, 16 Feb may see the commodity opening lower. At this juncture. At this juncture, the FCPO still charting a “higher low” bullish pattern and support levels are still intact. As such, the commodity may consolidate lower for the immediate session, before trading momentum picks up again to push the FCPO to retest the immediate threshold of MYR5,700. For now, we maintain a positive trading bias.

Traders should remain in the long positions initiated at MYR4,649, or the close of 24 Dec 2021. To continue to ride on the uptrend while minimising the trading risks, the trailing-stop has been set at MYR5,445.

Using May 2022 futures contract as a reference, the immediate support has shifted lower to MYR5,450 followed by MYR5,278. Conversely, the nearest resistance is still at MYR5,700 – 31 Jan’s high – followed by MYR5,840 – which is in uncharted territory.

Source: RHB Securities Research - 16 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024