WTI Crude: Strong Profit-Taking From the Peak

rhboskres

Publish date: Wed, 16 Feb 2022, 05:37 PM

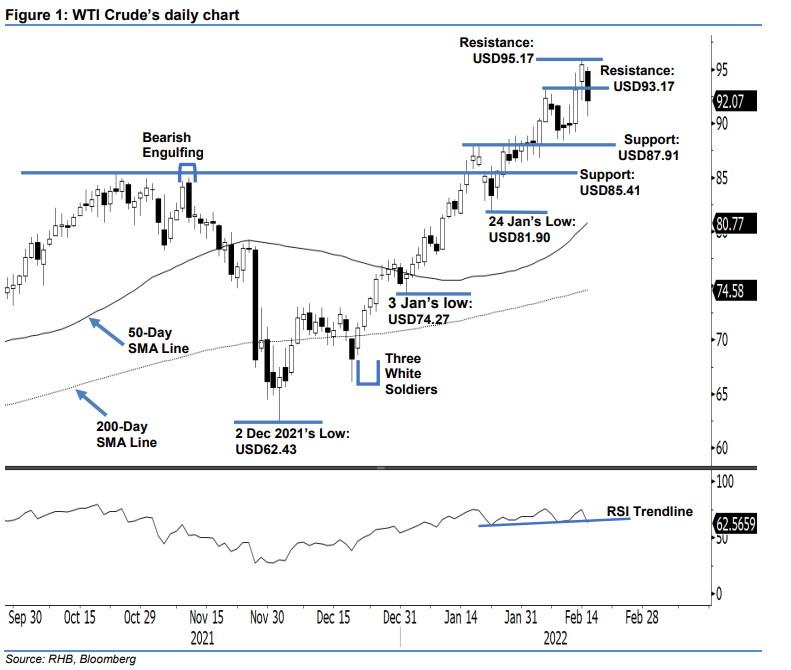

Maintain long positions. The WTI Crude reversed to a bearish momentum yesterday, falling USD3.39 to settle at USD92.07 – in line with global sentiment. It started the session at USD94.83 and oscillated sideways to the intraday high of USD95.17, before strong selling pressure kicked in during the later part of the Asian trading session. The bears took control towards the end of the session, with the commodity hitting the day’s low of USD90.66 before rebounding moderately to close at USD92.07. The bearish candlestick with lower shadow indicates that the bears were eager to take profit from the recent high, and the commodity is expected to continue falling towards the USD87.91 immediate support level – in line with our expectations. Coupled with the weaker RSI, which is pointing lower to the 62% level, we expect the bearish momentum to continue to dominate in the coming sessions, while the bulls take the lead in the medium term. As the trailing-stop was not breached, we keep our bullish trading bias.

Traders are recommended to maintain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage trading risks, the trailing-stop threshold is set at USD87.91, or the high of 19 Jan.

The immediate support is marked at USD87.91 (19 Jan’s high), followed by USD85.41 or 25 Oct 2021’s high. Meanwhile, the first resistance level is revised to USD93.17 (4 Feb’s high), and then USD95.17 or 15 Feb’s high.

Source: RHB Securities Research - 16 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024