FKLI: Bulls Take a Breather

rhboskres

Publish date: Thu, 17 Feb 2022, 04:23 PM

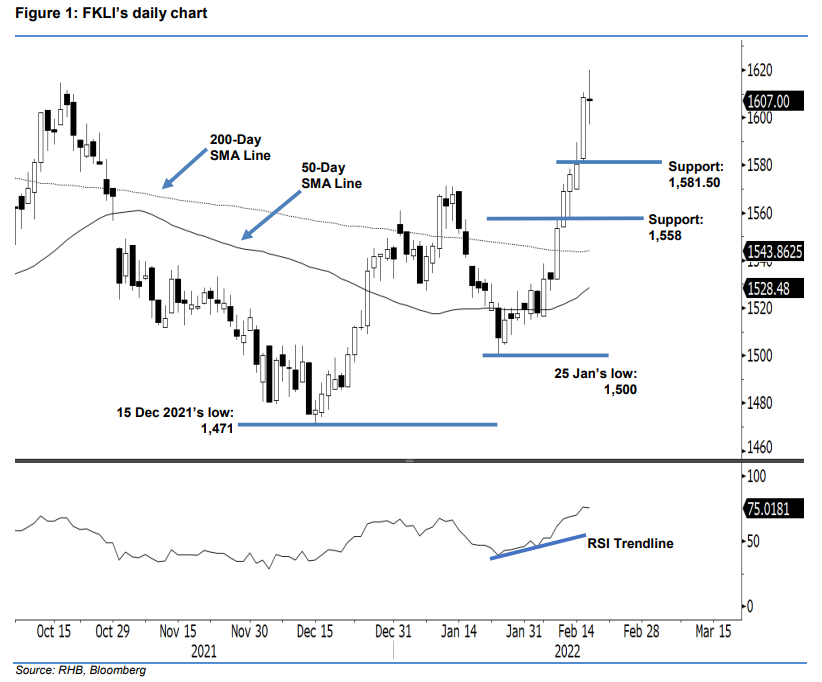

Maintain long positions. After reclaiming the 1,600-pt level, the FKLI closed neutral yesterday – slipping 1.5 pts to settle at 1,607 pts. The benchmark index started the night session at 1,608 pts. Once the morning session began, strong buying interest lifted the index to the day’s high of 1,620 pts. However, this was short-lived. Selling pressure quickly kicked in to drag the index towards the day’s low of 1,597 pts. It then rebounded strongly to recoup most of the losses towards the close. Despite the “doji” neutral candlestick seen yesterday, the FKLI is expected to remain bullish for as long as it stays above the immediate support level of 1,581.50 pts. For the immediate term, yesterday’s intraday high and low will provide the direction for the coming sessions. For now, we maintain our positive trading bias.

We recommend that traders stick to the long positions initiated at 1,527.50 pts, or the close of 3 Feb. To manage downside risks, the trailing-stop is set at 1,558 pts.

The immediate support is at 1,581.50 pts (15 Feb’s low), followed by 1,558 pts, which was the low of 11 Feb. Towards the upside, the first resistance is at 1,620 pts, and then 1,650 pts.

Source: RHB Securities Research - 17 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024