WTI Crude: Bouncing Mildly From the Pullback

rhboskres

Publish date: Thu, 17 Feb 2022, 04:29 PM

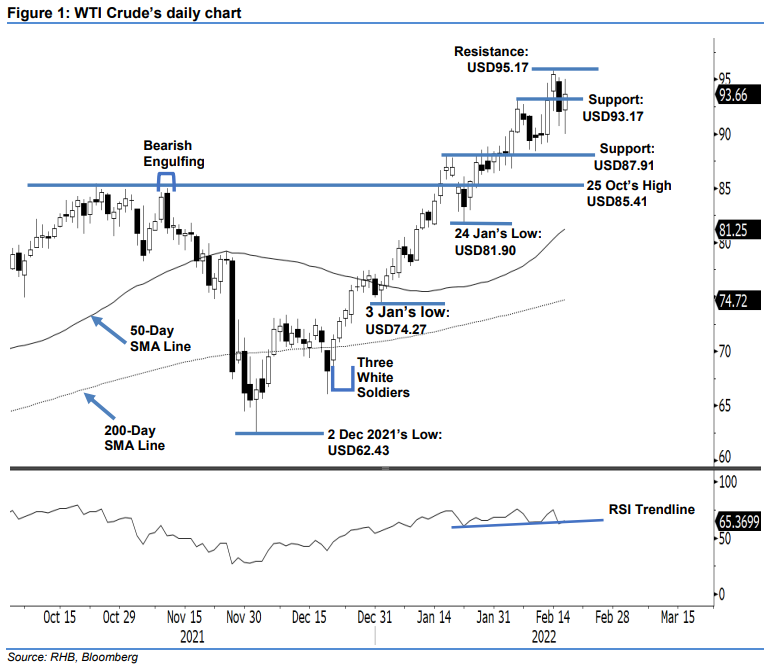

Maintain long positions. The WTI Crude displayed positive momentum yesterday, gaining USD1.59 to settle at USD93.66 – reclaiming its immediate resistance level of USD93.17. The commodity started the session at USD92.21 and then oscillated to touch the day’s low of USD90.00 before gradually climbing higher towards touching the day’s high of USD95.01. Strong profit-taking took place to drag it moderately towards the close. The bullish candlestick with upper and lower shadows shows the intraday bullish momentum has been tapered by the selling pressure. Hence, we expect the WTI Crude to remain volatile between the USD95.17 resistance and USD87.91 next support level. Hence, we keep to our bullish trading bias until the trailing-stop point is breached.

Traders are recommended to maintain the long positions initiated at USD73.79 or the closing level of 23 Dec 2021. To manage the trading risks, the trailing-stop threshold is set at USD87.91, ie the high of 19 Jan.

The immediate support is marked at USD93.17 – 4 Feb’s high – and then USD87.91, which was 19 Jan’s high. Meanwhile, the first resistance level is revised to USD95.17 – 15 Feb’s high – and followed by the USD100.00 psychological level.

Source: RHB Securities Research - 17 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024