COMEX Gold - Upside Risk Remains

rhboskres

Publish date: Mon, 21 Feb 2022, 09:55 AM

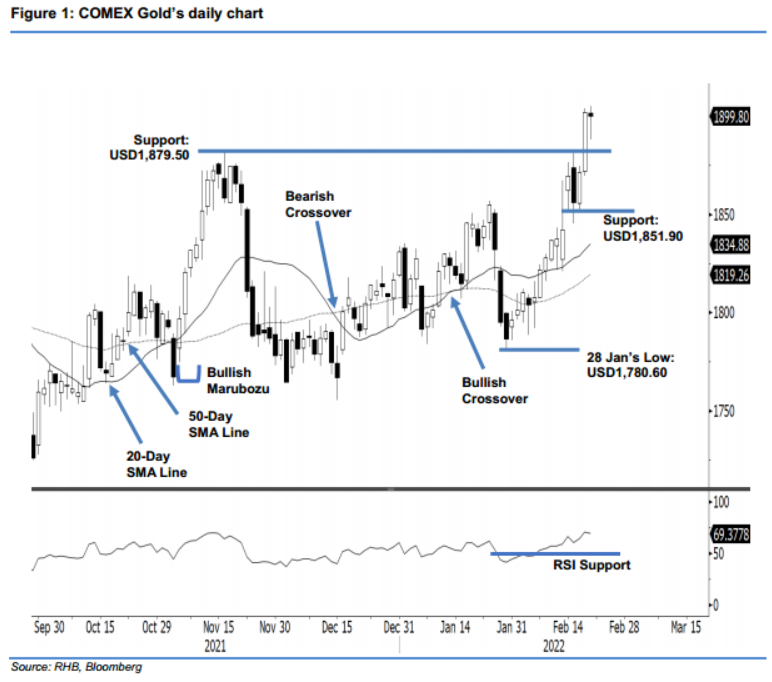

Maintain long positions. Despite the COMEX Gold experiencing mild profit-taking last Friday, and retreating USD2.20 to close at USD1,899.80, we think the bullish structure remains intact. The commodity opened at USD1,901.40 on Friday, and after oscillating between USD1,905 and USD1,888, it closed at USD1,899.80. Although the COMEX Gold charted a candlestick with long lower shadow, we think it is still premature to view this as a sign of a bearish reversal. The commodity has rallied since forming the low of USD1,780.60 on 28 Jan, and may pull back to retest the USD1,879.50 support level for a healthy consolidation. In the event that bullish momentum continues, the commodity may resume its upward trajectory towards the USD1,950 level. As there are no signs that the bulls are fatigued, we keep our bullish trading bias.

We advise traders to hold on to the long positions initiated at USD1,818.50, or the closing level of 11 Jan. To minimise trading risks, the trailing-stop is placed at USD1,851.90.

The immediate support stays at USD1,879.50 – 16 Nov 2021’s high – followed by USD1,851.90. Conversely, the first resistance is eyed at USD1,950, followed by the USD2,000 whole number.

Source: RHB Securities Research - 21 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024