FCPO - Heading Towards All-Time High Again

rhboskres

Publish date: Tue, 22 Feb 2022, 10:03 AM

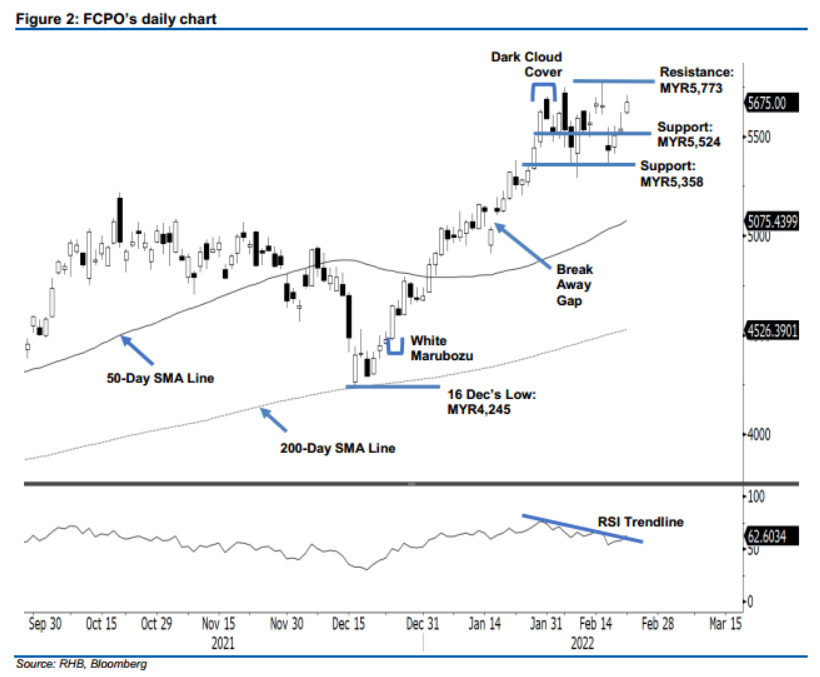

Stop-loss triggered; initiate long positions. The FCPO continued rising for the third consecutive session, jumping MYR136.00 yesterday to close at MYR5,675. Initially, the commodity gapped up and opened stronger at MYR5,622. After establishing the day’s low at MYR5,611, it climbed to test the day’s high of MYR5,708 before closing in positive territory. The latest price action has negated the Shooting Star charted on 18 Feb, and the FCPO is now poised to test the all-time high or immediate resistance of MYR5,773. The RSI has crossed above the trendline, which indicates that the bulls are picking up the pace. If the FCPO breaches the immediate threshold, it may negate the Dark Cloud Cover formed on 31 Jan, and venture into uncharted territory – possibly reaching MYR5,840, ie new high. Meanwhile, towards the downside, expect the support to be formed at MYR5,524. Since the commodity has surpassed the stop-loss on the back of strong momentum, we shift our trading bias to a positive one.

We closed out the short positions which were initiated at MYR5,437 or the closing level of 16 Feb, after the stop-loss of MYR5,623 was triggered. Conversely, traders can initiate long positions at the close of 21 Feb, ie MYR5,675. To manage the trading risks, the initial stop-loss is set at MYR5,300.

The immediate support has been revised to MYR5,524 – 18 Feb’s low – and followed by MYR5,358 or the low of 16 Feb. On the other hand, the first resistance is at MYR5,773 (15 Feb’s high), then MYR5,840 which is in uncharted territory.

Source: RHB Securities Research - 22 Feb 2022

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024